Japanese Yen (USD/JPY, EUR/JPY) Analysis

Recommended by Richard Snow

How to Trade EUR/USD

USD/JPY Surrenders Prior Gains Ahead of the Weekend

USD/JPY is back above the 150.00 marker just one day after encouraging comments from BoJ board member Hajime called for a change in monetary policy now that the Bank’s 2% target is in sight.

All parties (markets and the BoJ) now look ahead to crucial wage negotiations that are scheduled to wrap up around the 13th of March. Labour unions have been lobbying for sizeable wage increases and businesses have appeared largely receptive to the requests given inflation has breached the 2% mark for over a year already.

It appears that markets are more inclined to favour the carry trade – involving borrowing the cheaper yen in favor of investing in higher yielding currencies – over persistent yen strength. This is of course, until we get an idea of whether Japanese firms agree to the highest wage increases in years.

Wages appear to be the last piece of the puzzle and BoJ Governor has often sought a ‘virtuous cycle’ between wages and prices as the main determinant for policy change.

USD/JPY pulled back yesterday already and today the pair continues the move to the upside, above 150. A very narrow range has appeared between 150 and 150.90, with FX markets appearing unconvinced about FX intervention and an imminent policy change from the Bank of Japan.

Risk management is key in such situations if the prior intervention from Japanese officials is anything to go by. Price swings around 500 pips have transpired in 2022 so there is great risk of a massive pick up in volatility.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

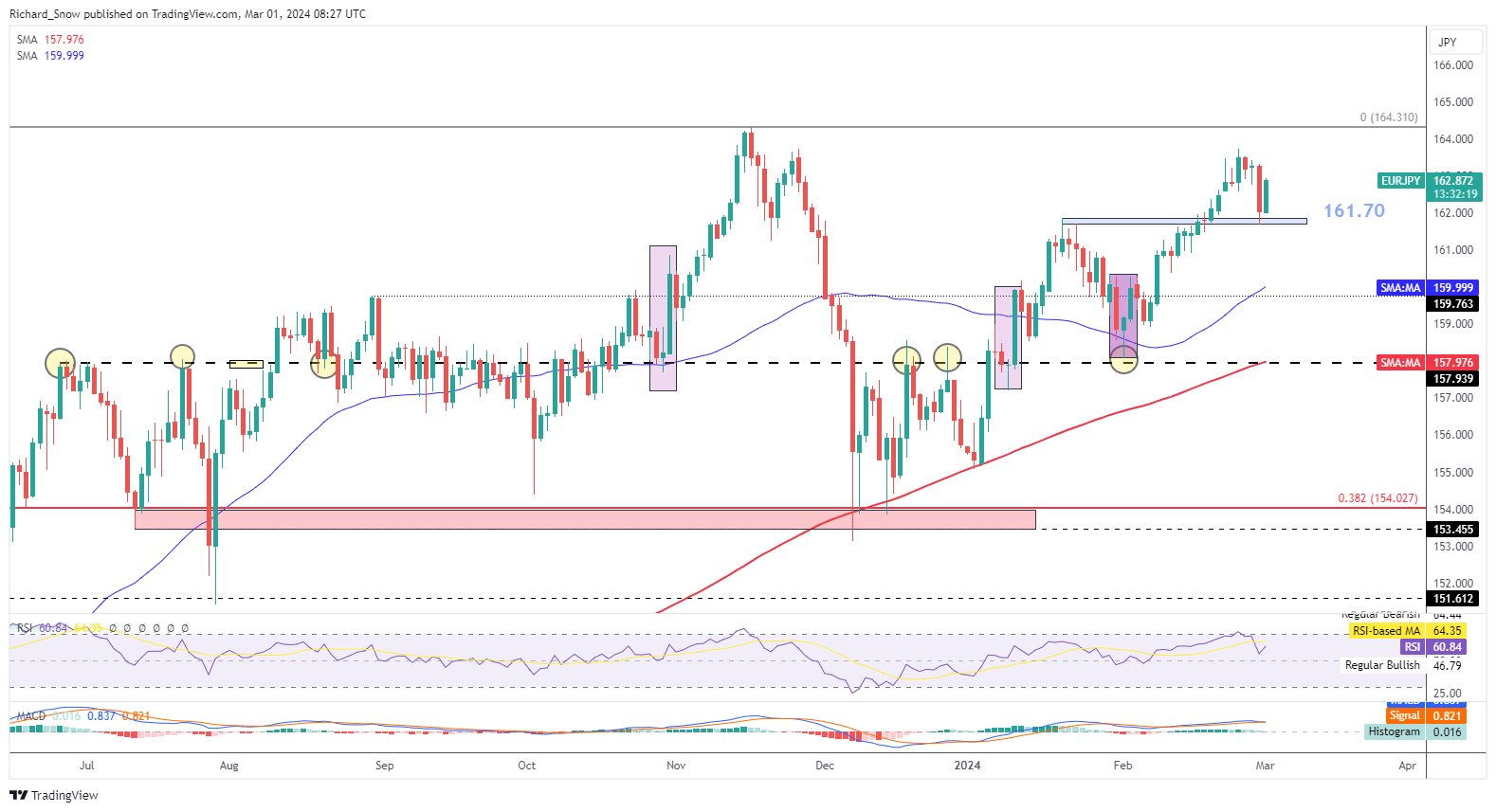

EUR/JPY Finds Support Ahead of ECB Meeting Next Week

The ECB is due to meet next week Thursday where it is highly unlikely the governing council will vote to cut interest rates. ECB officials have been attempting to push back against rate cuts as they prefer to follow the US in such matters. However, Europe’s economic growth is stagnant at best, oscillating around 0% and with Germany tipped to already be in a recession.

EUR/JPY looks to have found support at the previously identified zone around 161.70. The pair adheres to a longer-term bullish profile with prices above the 50 SMA and the 50 SMA above the 200 SMA. Another test of the 164.31 swing high is not to be discounted, particularly in the first two weeks of the month (before wage negotiations have concluded).

EUR/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Stay up to date with breaking news and major market themes driving the market. Sign up to our weekly newsletter

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

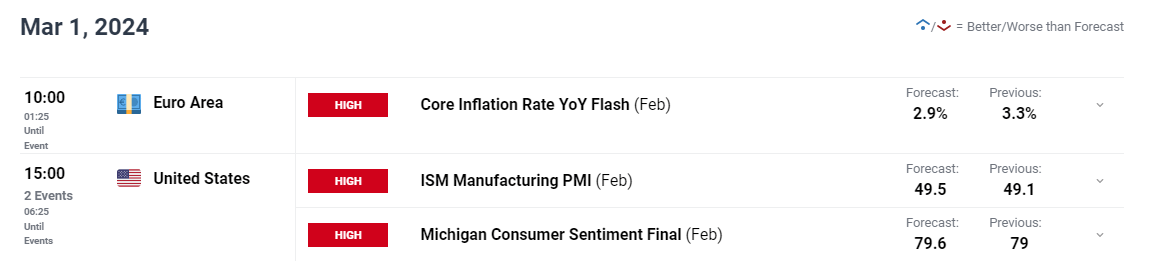

Major Event Risk Ahead

Later today Euro Area inflation for Feb is expected to drop from 3.3% to 2.9% for the core measure and expecting to see a similar decline in the headline measure from 2.8% to 2.5%. A lower all-round inflation print is likely to draw the attention to next week’s ECB monetary policy meeting where there is little expectation of a rate cut. Markets price in a strong probability that the first rate cut will take place in June despite Europe’s economy in need of support right now. The European Union has witnesses stagnant growth on the whole as quarterly GDP growth figures have oscillated around 0% for the last 5 quarters.

Customize and filter live economic data via our DailyFX economic calendar

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Leave a Reply