Gold (XAU/USD) Analysis

- Gold pushes on despite subdued volatility as the dollar and US yields ease

- Gold tracks trendline resistance and tests 50-day simple moving average

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

How to Trade Gold

Gold Pushes on Despite Subdued Volatility as the Dollar and US Yields Ease

Implied gold volatility derived from the derivatives market remains subdued and shows little indication of a spike higher. Typically, gold prices rise during periods of elevated volatility and are more likely to peter out during periods of lower volatility.

However, a softer dollar and slightly lower US yields on Tuesday helped extend gold’s bullish advance. Gold prices tend to move inversely to the dollar as a softer greenback provides a slight discount for foreign purchases of the precious metal.

Implied 30-Day Gold Volatility Index (GVZ)

Source: TradingView, prepared by Richard Snow

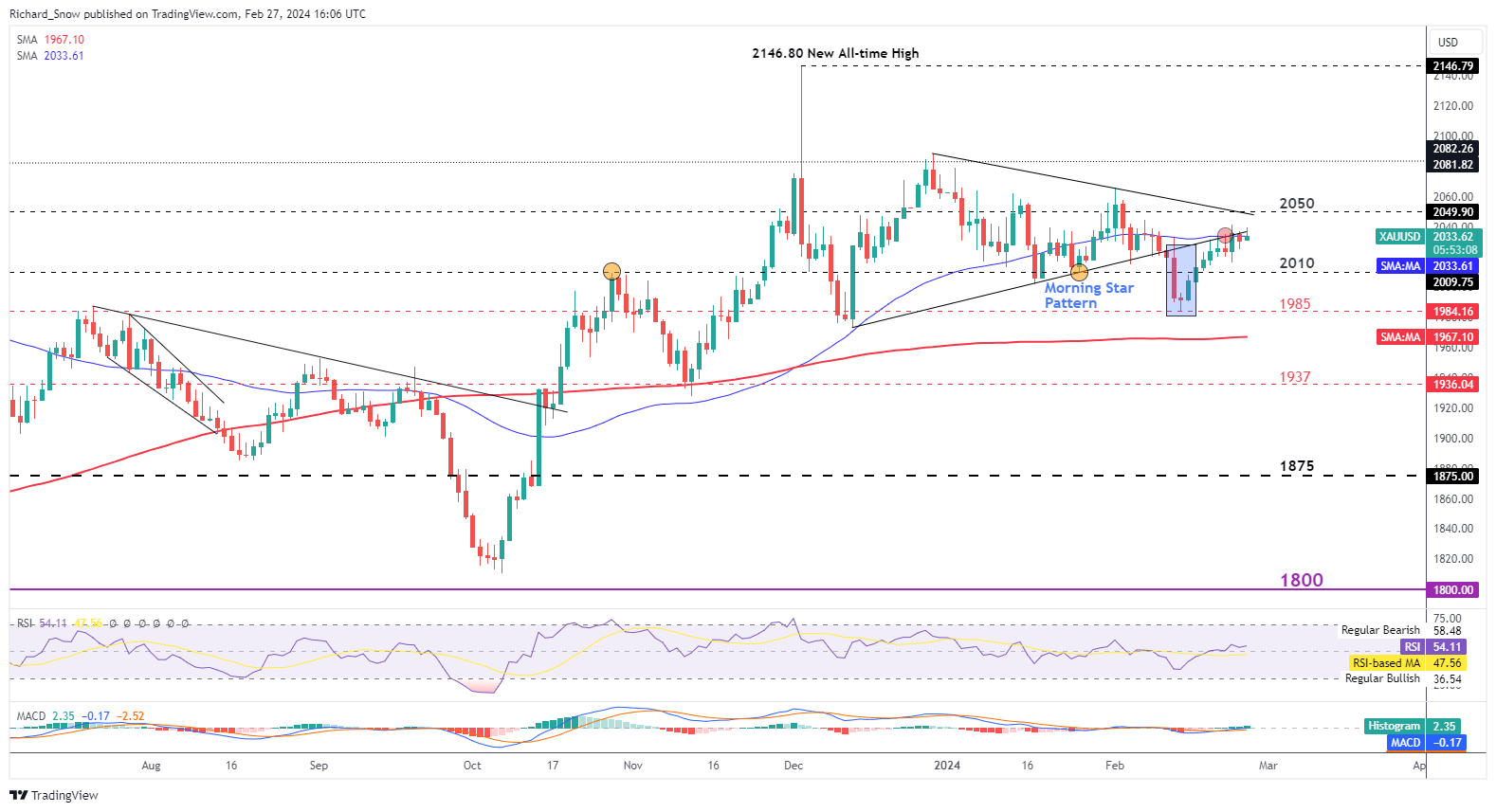

Gold Tracks Trendline Resistance and Tests the 50-Day SMA

Gold has performed well considering markets have dialed back aggressive rate cuts for 2024. At the end of last year, 2024 was shaping up to be a strong year for gold as rate cuts were expected to arrive as early as Q1, with the new year expected to see around six separate 25 basis point (bps) cuts from the Fed. Lower interest rates make the non-interest-bearing metal more attractive and the safe haven appeal of the metal added another string to the asset’s bow at a time of increasing geopolitical tension.

However, markets have realized the error in their ways and have been forced to meet the Fed around their initial forecast of three rate cuts for the year. Thus, yields have actually risen and yet gold has held up rather well. According to a report from Reuters, in January China’s net gold imports via Hong Kong reached its highest level since the middle of 2018, Central bank purchases have helped to support gold prices alongside middle class citizens looking to preserve wealth amid a beleaguered property sector.

Gold appears all too happy to track alongside former trendline support, now resistance with the blue 50-day simple moving average capping upside for now. $2050 is the next hurdle to further upside while $2010 may signal a pullback towards $1985 but the lack of volatility means any move is likely to be a measured one unless US Q4 GDP (second estimate) or PCE data surprises everyone.

Gold (XAU/USD) Daily Chart

Source: TradingView, prepared by Richard Snow

Stay up to date with the latest breaking news and market themes that are driving the market currently by signing up to our newsletter:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Leave a Reply