Want to know more about the U.S. dollar‘s technical and fundamental outlook? Find all the insights in our Q1 trading forecast. Grab your copy now!

Recommended by Diego Colman

Get Your Free USD Forecast

Most Read: Markets Q1 Outlook – Gold, Stocks, EUR/USD, GBP/USD & USD/JPY Eye Fed, US Yields

The U.S. dollar, as measured by the DXY index, fell on Monday following its robust showing the previous week, undermined by the pullback in Treasury yields ahead of key economic data in the coming days, including the release of the U.S. CPI survey on Thursday.

With the Fed’s commitment to a data-driven strategy, the upcoming December inflation report will hold substantial weight in shaping future monetary policy actions. For this reason, traders should closely track data on consumer prices going forward.

In this context, EUR/USD and GBP/USD pushed higher in late afternoon trading in New York, resuming their upward journey. USD/JPY, for its part, retreated moderately, heading back towards its 200-day simple moving average. This article focuses on these three FX pairs, examining their near-term outlook from a technical standpoint.

US YIELDS AND SELECT FX PERFORMANCE

Source: TradingView

Fine-tune your trading skills and stay proactive in your approach. Request the EUR/USD forecast for an in-depth analysis of the euro’s outlook!

Recommended by Diego Colman

Get Your Free EUR Forecast

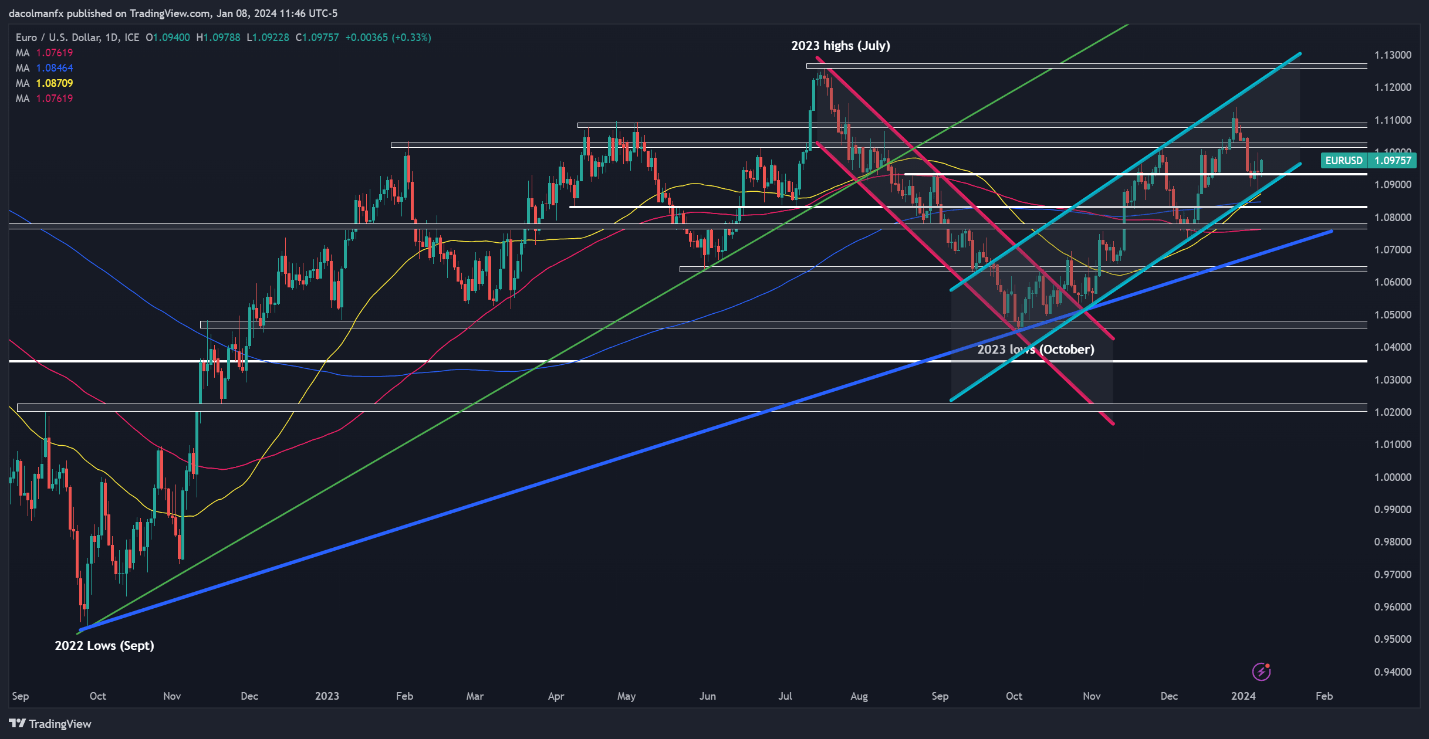

EUR/USD TECHNICAL ANALYSIS

EUR/USD corrected downwards from late December to early January, but managed to stabilize and bounce after finding support near 1.0875, which corresponds to the lower boundary of a short-term ascending channel, as shown in the chart below. If the rebound gains momentum in the coming days, technical resistance appears at 1.1020, followed by 1.1075/1.1095.

On the flip side, if sellers return and drive prices lower, the first line of defense against a bearish assault can be spotted at 1.0930. On further weakness, the focus shifts to 1.0875. Bulls must protect this floor at all costs; failure to do so could usher in a move towards the 200-day simple moving average, followed by a descent towards the 1.0770 area.

EUR/USD TECHNICAL CHART

EUR/USD Chart Created Using TradingView

Interested in learning how retail positioning can offer clues about GBP/USD’s near-term path? Our sentiment guide has valuable insights about this topic. Download it now!

Recommended by Diego Colman

Get Your Free GBP Forecast

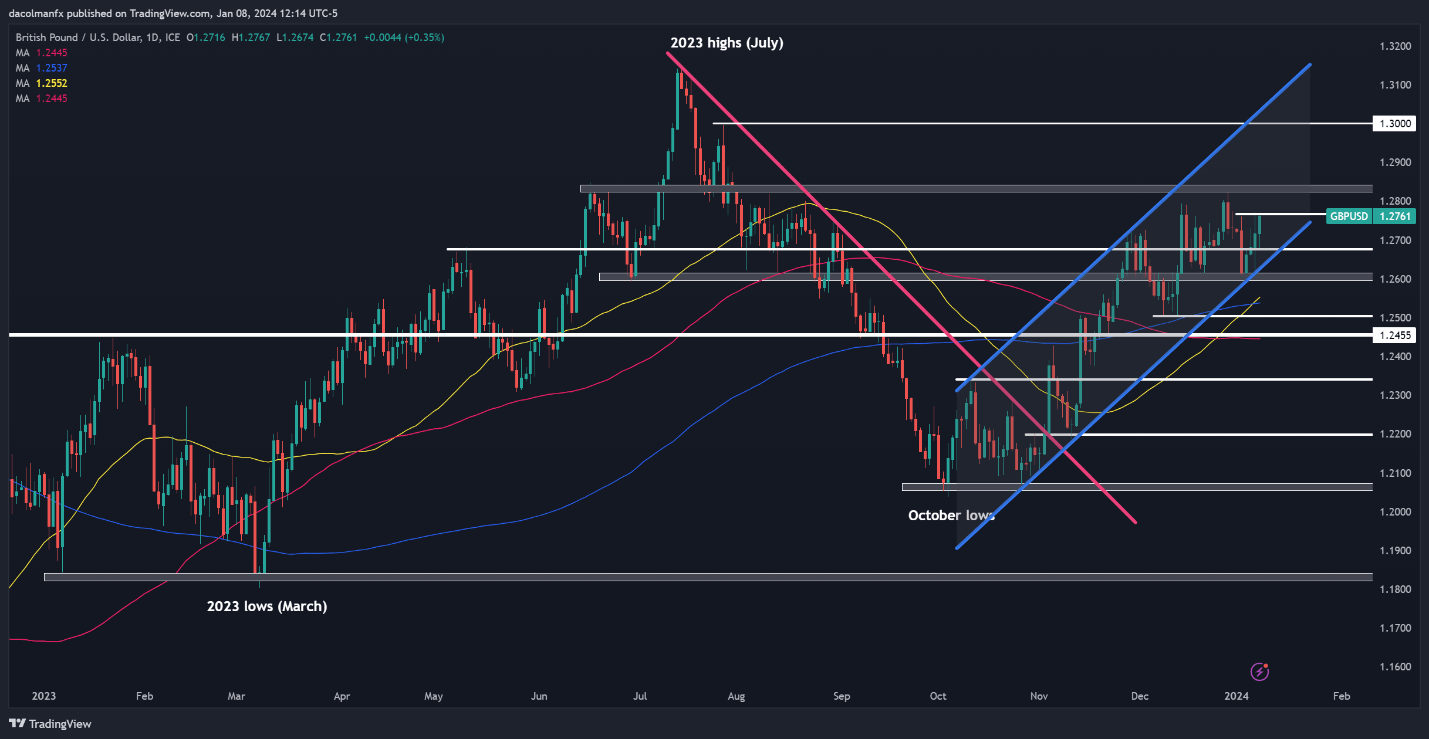

GBP/USD TECHNICAL ANALYSIS

GBP/USD extended gains for the third straight trading session, coming within striking distance from overtaking overhead resistance at 1.2765. With bullish impetus on its side, cable could clear this technical barrier soon, paving the way for a possible retest of the December highs slightly above the 1.2800 handle. Continued strength would draw attention to the psychological 1.3000 level.

Alternatively, if GBP/USD gets rebuffed from its current position, a retracement toward 1.2675 could unfold in short order. Bulls are likely to staunchly defend this floor; however, a breach may open the door for a drop toward channel support at 1.2630. Continued weakness could encourage sellers to set their sights on the 200-day simple moving average.

GBP/USD TECHNICAL CHART

GBP/USD Chart Created Using TradingView

For a complete overview of the Japanese yen’s prospects, request your complimentary Q1 trading forecast now!

Recommended by Diego Colman

Get Your Free JPY Forecast

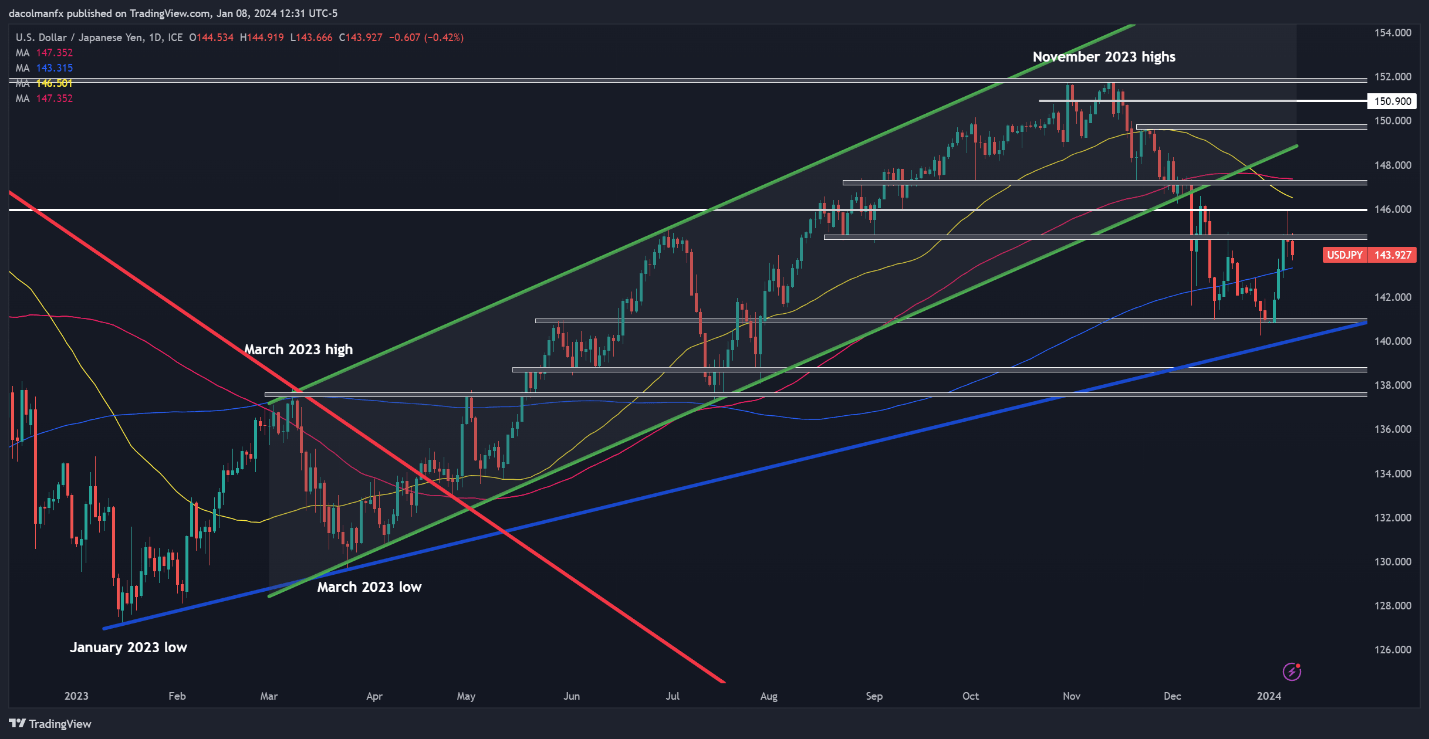

USD/JPY TECHNICAL ANALYSIS

USD/JPY initiated a strong rally at the beginning of the year, but its climb abruptly stalled when it couldn’t break through the psychological resistance at 146.00, with sellers returning and pushing prices back down towards the 200-day simple moving average. The integrity of this support is pivotal; otherwise, a return to December’s lows could be in the cards.

On the other hand, if bulls regain decisive control of the market and manage to propel the exchange rate higher, resistance looms at 144.75, followed by 146.00. Previous attempts to push past this ceiling have been unsuccessful, so history could repeat itself in another test, but in the event of a sustained breakout, a rally toward the 147.00 handle could develop.

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Using TradingView

Leave a Reply