US Dollar Analysis, Price, and Chart

- Fed Chair Powell remains positive but data dependent.

- US Dollar Index drifts lower and now looks to Friday’s NFP report for guidance.

- Gold posts a fresh record high.

Recommended by Nick Cawley

Get Your Free USD Forecast

Fed Chair Jerome Powell gave the market little to work with at the first of his two semi-annual testimonies on Wednesday, bar reiterating that interest rates are likely to move lower later this year if economic data permits. Chair Powell told the House that rate cuts will “likely be appropriate” later this year… “if the economy evolves broadly as expected”, and that inflation is expected to continue falling going forward. Day two of Powell’s testimony starts at 15:00 UK today and it is not expected to provide any further insights into the future path of US interest rates.

A more likely driver of US dollar volatility will be Friday’s monthly US Jobs Report (NFPs) which hit the screens at 13:30 UK. A further 200k new jobs are expected to be announced, sharply lower than last month’s blockbuster 353k, while the unemployment rate is seen steady at 3.7%.

For all economic data releases and events see the DailyFX Economic Calendar

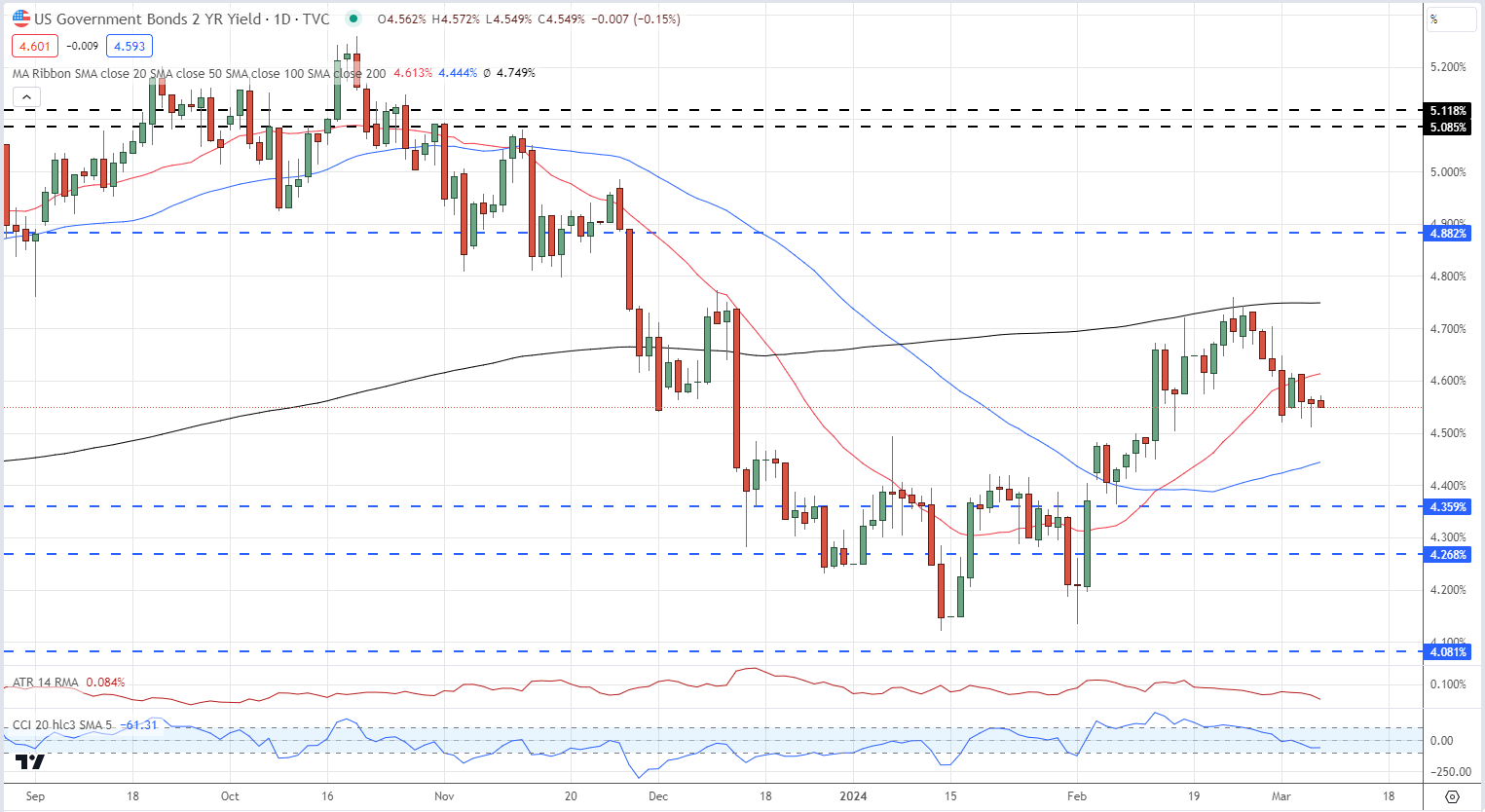

The US dollar slipped lower on Chair Powell’s testimony yesterday and remains on the defensive in early European turnover. The yield on the rate-sensitive US 2-year continues to move lower after hitting a recent 4.76% peak on February 23rd and may soon test 4.50%. The 200-day simple moving is acting as resistance for now and is likely to keep yields capped.

US Two-Year Treasury Yield Daily Chart

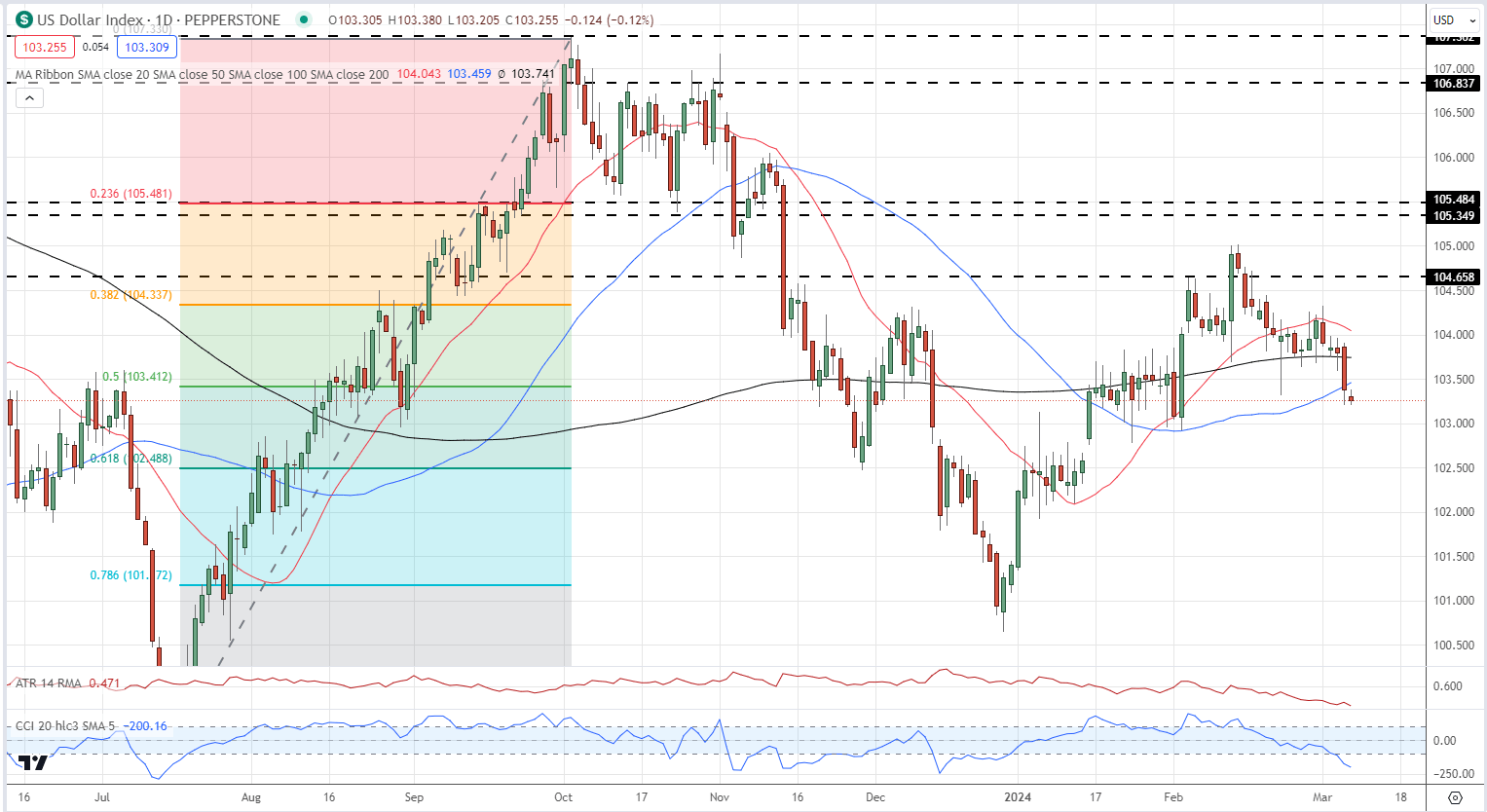

The US dollar index today opened below all three simple moving averages for the first time since early January, highlighting the current weakness of the greenback. A further sell-off would eye 103.00 before the 61.8% Fibonacci retracement level at 102.49 comes into focus. The CCI indicator shows the US dollar in heavily oversold territory.

US Dollar Index Daily Chart

Learn how to trade gold with our free Gold Trading Guide

Recommended by Nick Cawley

How to Trade Gold

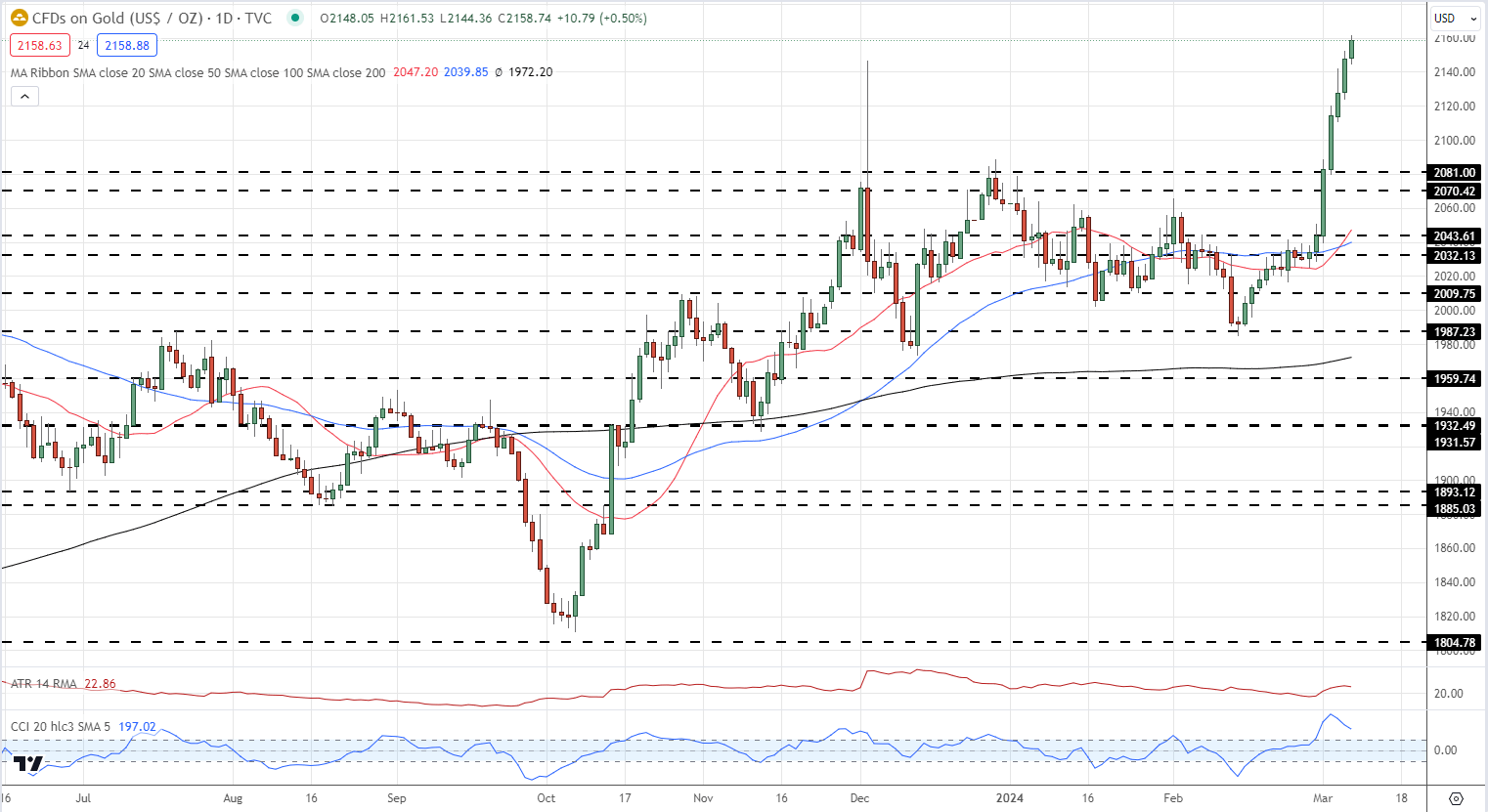

One beneficiary of recent US dollar weakness is gold, with the precious metal posting a fresh all-time high earlier today. Gold has rallied by nearly 9% since the February 14th low and looks set to move higher in the weeks ahead although a heavily overbought CCI reading may see the precious metal consolidate recent gains before pushing further ahead.

Gold Daily Price Chart

All Charts via TradingView

IG Retail trader data shows 43.06% of traders are net-long with the ratio of traders short to long at 1.32 to 1.The number of traders net-long is 7.09% lower than yesterday and 15.59% lower than last week, while the number of traders net-short is 2.11% higher than yesterday and 48.39% higher than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Gold prices may continue to rise.

| Change in | Longs | Shorts | OI |

| Daily | -6% | 4% | -1% |

| Weekly | -14% | 46% | 12% |

What is your view on the US Dollar and Gold – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Leave a Reply