POUND STERLING ANALYSIS & TALKING POINTS

- UK GDP may be showing signs of exhaustion long-term.

- Soaring gilt yields bring pensions schemes back into the picture.

- FOMC in focus.

- Trendline resistance under the spotlight.

Recommended by Warren Venketas

Get Your Free GBP Forecast

UK GDP IS POSITIVE AT SURFACE LEVEL

The British pound back in the picture once more this morning with UK GDP being the focal point for traders. Cable is trading relatively flat after yesterday’s positive close due to UK GDP releasing in line with expectations on most metrics (see economic calendar below). Highlights include:

- Monthly GDP up 0.2% (April) after a decline of 0.3% in March.

- GDP grew by 0.1% for the 3-month figure to April.

- Services sector pushed higher (0.3%) after a fall of 0.5% for March.

Source: ONS

In summary, the report is a net positive short-term for GBP with some shortcomings from the industrial and manufacturing sectors. Looking at the overall picture, it seems UK growth is stagnating somewhat and could be cause for concern later on. Chancellor of the Exchequer Jeremy Hunt responded to the robust UK economic data by stating that “high growth needs low inflation and we must stick relentlessly to our plan to halve rate this year.” Similar sentiments about inflation were emphasized yesterday via the Bank of England (BoE) Governor Andrew Bailey and Dhingra respectively.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

UK ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

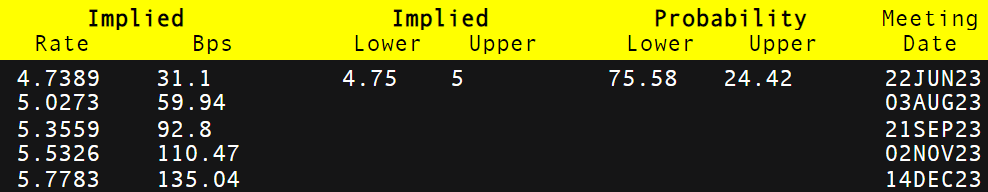

A drastic change in BoE rate hike expectations post-jobs data yesterday now has the peak rate for 2023 up at almost 5.77% (refer to table below) from around 5.48% – roughly 30bps higher!

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Source: Refinitiv

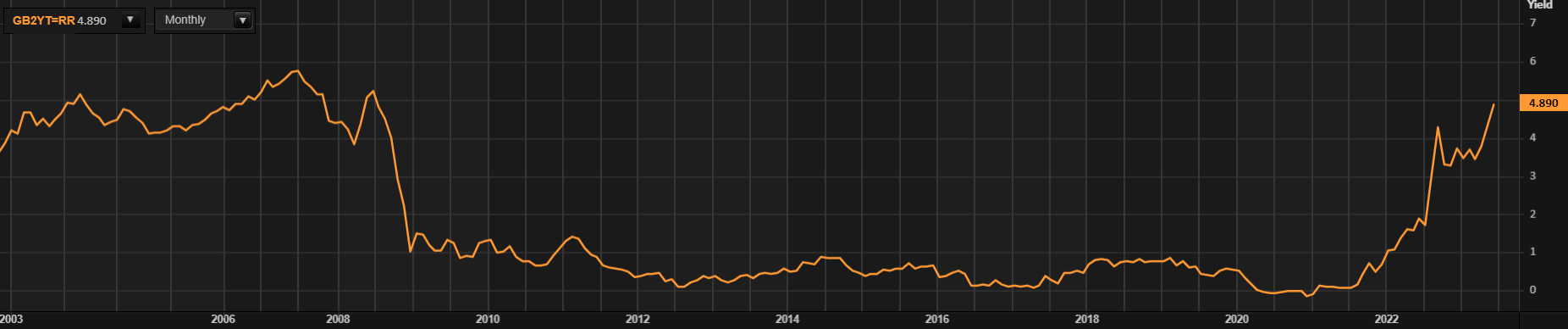

The UK 2-year gilt yield below now shows levels last seen in 2008 and well above the period surrounding former PM Liz Truss. This could bring back concerns around Defined Benefit (DB) pension schemes as the value of these pension schemes traditionally move inversely to gilt yields.

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

UK 2-YEAR GILT YIELD

Source: Refinitiv

TECHNICAL ANALYSIS

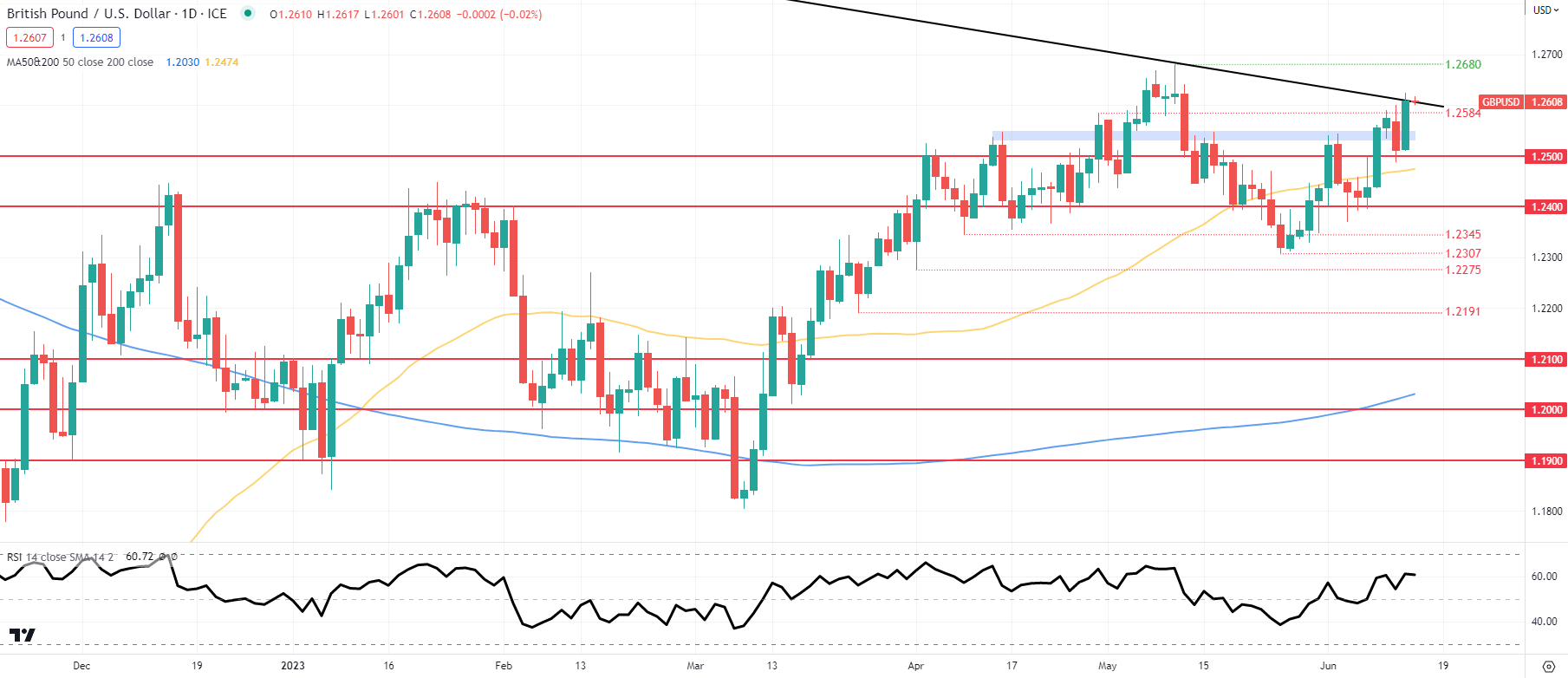

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily cable chart shows sterling relatively flat this morning but still very much elevated. Attention will now shift over to the Federal Reserve and its interest rate announcement. Expectations are for the FOMC announcement to result in a pause/skip due to declining US CPI data yesterday thus reducing the interest rate differential between the two economies in favor of a stronger pound if the BoE sticks to current money market pricing.

GBP bulls are now testing the long-term trendline resistance zone (black) and a confirmation close above this key inflection point could spark an extended rally up towards the 1.2680 swing high.

Key resistance levels:

- 1.2680

- Trendline resistance

Key support levels:

- 1.2584

- 1.2500

- 50-day MA (yellow)

- 1.2400

BULLISH IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently net SHORT on GBP/USD with 63% of traders holding short positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term upside disposition.

Contact and followWarrenon Twitter:@WVenketas

Leave a Reply