If you’re looking for an in-depth analysis of U.S. equity indices, our first-quarter stock market forecast is packed with great fundamental and technical insights. Get the full trading guide now!

Recommended by Zain Vawda

Get Your Free Equities Forecast

2023 in Review

US equities held their own throughout 2023, surging toward the end of the year with the Nasdaq 100 printing fresh all-time highs. A surprise given the narrative throughout the year and concerns around a potential recession around the globe and the US as well. The narrative has shifted since, and after the Federal Reserve meeting in December, market hopes for a soft landing have resurfaced. Given all the hope and market expectations it is important to keep things in perspective as the global economy continues its post-pandemic recovery.

Just looking at the broader economic activity, the US economy has grown by less than 1.8% a year since the pandemic. This is well below what the Central Bank expected and much slower than the forecasts made pre-pandemic. This has brought up some key questions regarding a structural change in the global economy with higher interest rates, higher inflation and rising debt levels leaving the Global economy in an interesting place heading into 2024.

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the first quarter!

Recommended by Zain Vawda

Get Your Free Top Trading Opportunities Forecast

Federal Reserve Rate Cuts in Q1 2024

Heading into 2024 and markets are now no longer debating on how high rates will go but rather when rate cuts will begin in 2024. Markets continue to price in around double the amount of rate cuts which the Fed sees in 2024 with Fed Policymaker Rafael Bostic terming the market response as ‘interesting’. Bostic himself has maintained a balanced approach stating that the Fed won’t jump at the first data point as he believes inflation still has a way to go.

Q1 in my opinion is likely to be a quarter where we continue to see anticipation and constant repricing of rate cuts with the chance of easing remaining slim. Markets are pricing in the first-rate cuts from the US Federal Reserve in May/June 2024 and this continues to change as data is released. Central banks have been quick to stress that market participants and consumers need to come to terms that we are going through a structural change with a higher rate environment likely to be the new norm.

All in all, rate cut expectations are likely to sway back and forth as data is released in Q1. Below we have a table indicating the current probabilities for rate cuts in 2024.

Source: CME FedWatch Tool

If you’re puzzled by trading losses, why not take a step in the right direction? Download our guide, “Traits of Successful Traders,” and gain valuable insights to steer clear of common pitfalls that can lead to costly errors.

Recommended by Zain Vawda

Traits of Successful Traders

The Magnificent 7 Continue to Outpace the Rest of the S&P 500

The growing disconnect between the Magnificent 7 (Apple, Amazon, Alphabet, NVIDIA, Meta, Microsoft, and Tesla) and the S&P 493 (remaining 493 companies) is now 63%. The gap continues to grow and does not seem like it is about to narrow anytime soon with the rise of AI only exacerbating the matter.

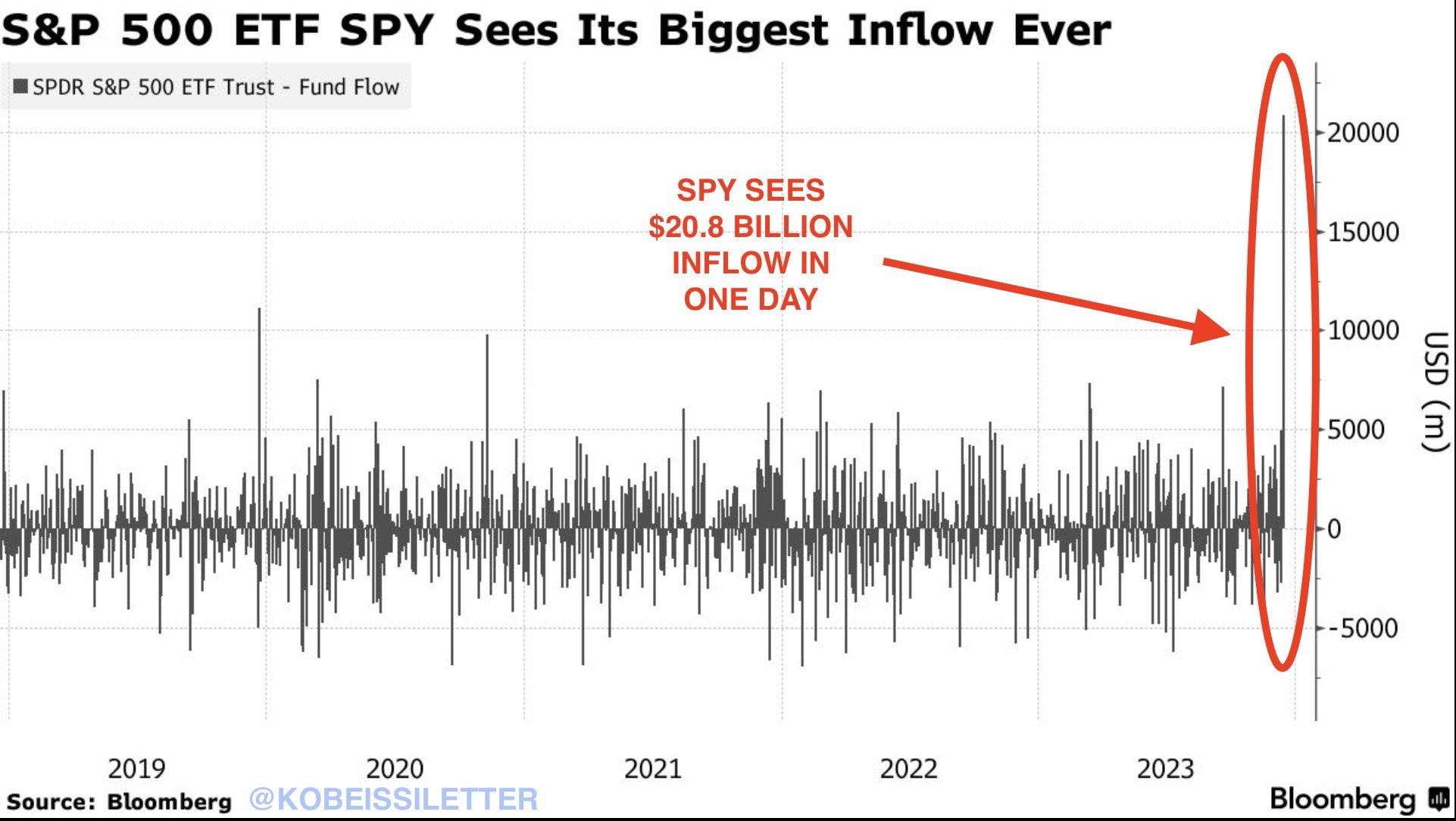

The anomalies do not stop there however with 81% of stocks in the S&P 500 currently trading higher than their 100-day moving average. This has taken place twice in 2023 already while December saw the SPY ETF recorded a daily record inflow of around $20 billion on Friday, December 15. The total for the week came to $24 billion which continued on December 19 with another big day of around $10 billion of inflows. Now I consider this extremely interesting given the rise since mid-November in US Equities which are now trading either at all-time highs or near all-time highs. The total here means the S&P 500 ETF recorded $35 billion of inflows in a 6-day period at an average of $5.8 billion per day.

Digging deeper into the numbers, year-to-date total inflows for the SPX ETF are at $50 billion. This means that around 70% of YTD inflows for the SPX ETF have happened over the 6 trading days mentioned above. This is another sign of market expectations for a soft landing and rate cuts in 2024. Are market participants overly optimistic?

Source: The Kobeissi Letter

Want to understand how retail positioning can impact the S&P 500’s journey in the near term? Request our sentiment guide to discover the effect of crowd behavior on market trends!

| Change in | Longs | Shorts | OI |

| Daily | -9% | -3% | -5% |

| Weekly | 16% | -6% | 1% |

The Rise of AI and the Potential Impact

Looking at what we discussed above and the growth of the major technology companies in 2023, a lot of this is down to the rise of AI in the second half of 2023. Given the developments since then the ride is definitely not over yet with its impact on revenue growth and profitability likely to increase as AI adoption does as well. Many companies have begun using AI and incorporating it in day-to-day processes which is another sign of the mass adoption that is likely to become a reality.

The Key factor I will be monitoring in this regard will be corporate earnings from Q4 2023. There were signs of it in the Q3 earnings season but I think Q4 will give a better indication as a lot more companies continue to adopt the technology. Investors are bullish on AI over the longer term the question here is how much will likely be priced in and how much it may boost US Equities in Q1. The concern over the short-term was the high-rate environment, potential Government regulation and a potential recession. The higher rate situation seems to be in the past but the risk of a recession and potential regulation remain. Now there is a possible comparison with the mass implementation of PCs at the end of the last century. Based on research the S&P 500 index priced the innovations’ impact as the productivity boom was realized, returning 26% annually between 1994 and 1999, near the peak in productivity growth.

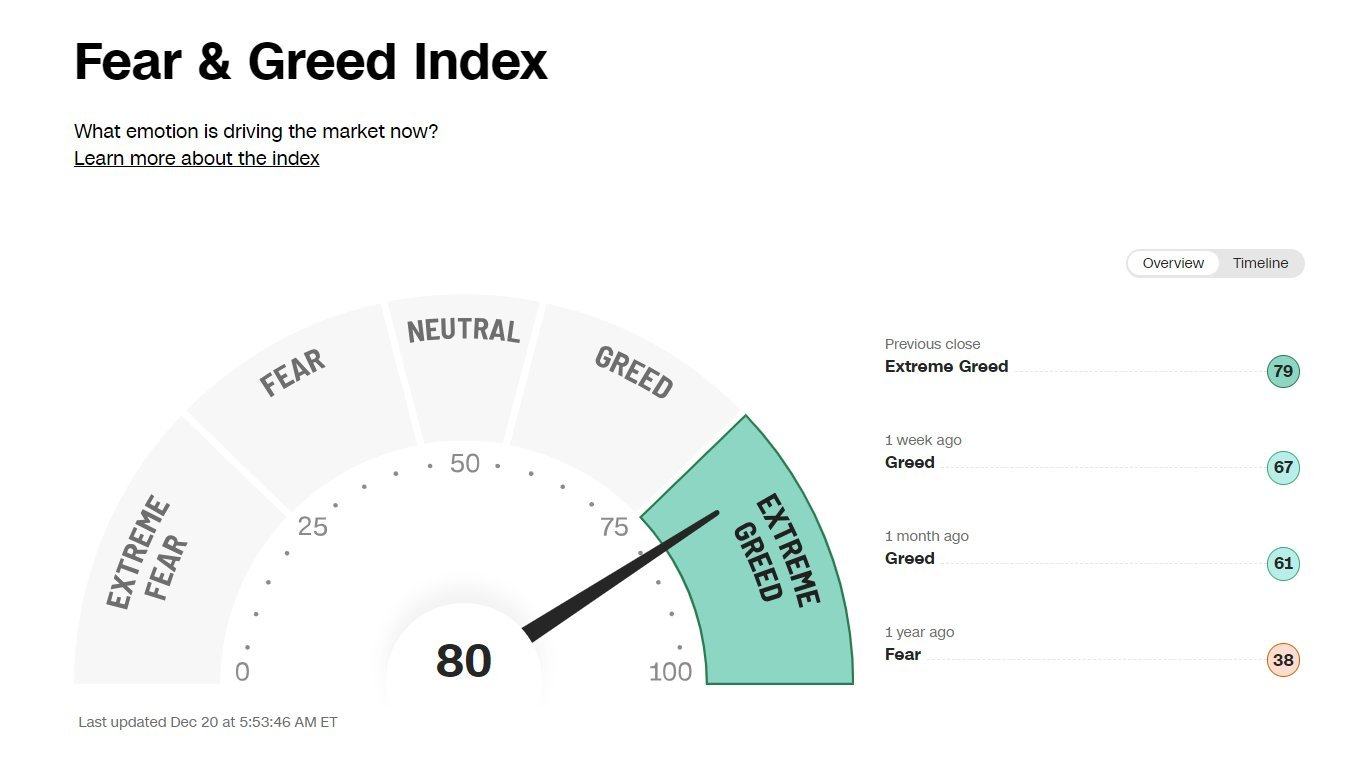

The risks are there as well with many analysts using the dot-com boom as an example. During the late 1990s, many companies failed to live up to market expectations and thus saw their share price and valuations plummet. It is important to note that during this period sales actually grew but the fact that market expectations were not met weighed on the sector. This is something to keep in mind as investor expectations over the last 18 months have gotten even more optimistic than usual, in my humble opinion. This is also shown by the Fear and Greed index which reached the 80 mark, a sign of extreme greed. This is the first time since July 27th 2023 that this occurred and paints an intriguing picture when one tie in the SPX ETF inflows as well.

Source: FinancialJuice

A risk which may play a huge role in effective AI adoption as well as the speed at which it is adopted is the growing calls for regulation. Similar to crypto markets and AI faces growing calls for regulatory oversight given the potential implications (SKYNET Anyone). For now, this seems a way off given that the US regulators are still grappling with crypto regulation which is taking a long time. Given the intricacies, benefits and potential challenges of AI this is not something that can and should be glossed over but rather should be approached with a sense of care and diligence. Given these challenges all I would say maybe we should not count our chickens before they hatch.

Rising Geopolitical Tensions Could Weigh on Global Markets

December has rekindled fears that the Global Geopolitical Dynamics remain more fragile than ever. The rise in tensions between the Yemeni Houthi Rebels, Hezbollah and Israel is threatening to spillover, something which Central Bankers and the IMF warned remains a key risk for 2024.

One of the factors is already playing out as BP recently announced suspending ships using the Red Sea with other companies following suit. Maersk, one of the largest shipping and logistics companies also mentioned that using a different route could add up to two weeks of shipping time. The concern here is that increased shipping time could lead to a rebound in inflationary pressures with Oil prices rising as a result of this news. If this persists it could have a profound impact on risk sentiment and thus negatively impact rate cut expectations in 2024. The situation in the Middle East is constantly evolving and definitely needs to be considered moving forward.

Leave a Reply