There are now less than 50,000 blocks to go before the Bitcoin halving triggers.

A tweet from Bitcoin Woods highlighted the milestone, adding that this puts the halving date on April 22, 2024.

Based on this timeline, the event will occur in 342 days. However, this is expected to fluctuate depending on blocks closing sooner or later than the designated ten-minute interval.

Bitcoin community awaits halving

The Bitcoin halving refers to an inbuilt 50% reduction in the mining block reward that occurs every 210,000 blocks – usually every four years.

This upcoming halving will be the fourth in Bitcoin’s history, cutting the block reward from 6.25 BTC to 3.125 BTC. There are 33 halvings programmed into the protocol, with the last set to occur in 2140 when the block reward zeros.

With a fixed maximum supply of 21 million coins, halvings slow down the number of coins coming into circulation – thus hardwiring a scarcity mechanism into the protocol. In theory, this process impacts supply-demand dynamics, acting as a tailwind to price.

This expectation has played out based on past data, concocting a narrative that halvings are bull market catalysts.

However, it’s worth bearing in mind that having three data points is not statistically rigorous. Additionally, macroeconomic uncertainty was not a factor in previous halvings.

Past halvings

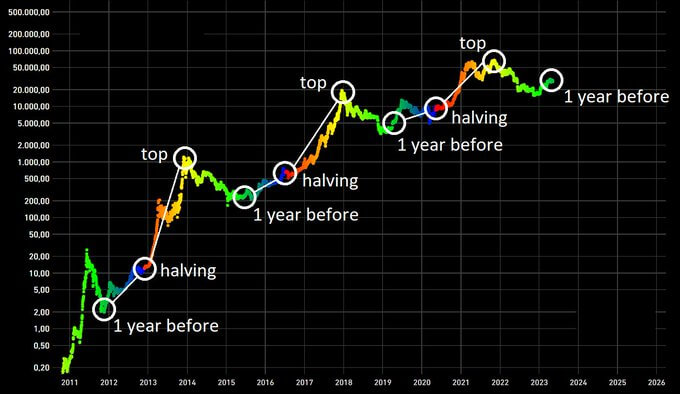

Bit Harington charted the Bitcoin price on a logarithmic scale, marking points for 1 year before, the halving itself, and the post-halving top.

The first halving – occurred on November 28, 2012, cutting the block reward from 50 BTC to 25 BTC.

- The price 1 year before was approximately $2.

- At the time of the halving was $12.35.

- By the top, around January 2014, the price was around $1,000.

This equated to a 7,997% increase from halving to post-halving top.

The second halving – occurred on July 9, 2016, cutting the block reward from 25 BTC to 12.5 BTC.

- The price 1 year before was approximately $270.

- At the time of the halving was $650.

- By the top, around December 2017, the price was around $19,800.

This equated to a 2,946% increase from halving to post-halving top.

The third halving – occurred on May 11, 2020, cutting the block reward from 12.5 BTC to 6.25 BTC.

- The price 1 year before was approximately $8,500.

- At the time of halving was $9,756.

- By the top, around November 2022, the price was $69,000.

This equated to a 607% increase from halving to post-halving top.

In all three cases, the price moved higher going into 1 year before, to the halving, to the post-halving top. As expected, with BTC now priced in five figures, the percentage increase from halving to the post-halving top has decreased.

If Bitcoin follows the same pattern this time, the price is expected to be more than $27,000 by the market top. COO at Onramp Jesse Myers puts the top price at between $120,000 and $240,000.

Leave a Reply