UK Spring Statement and Sterling Updates

Recommended by Richard Snow

How to Trade GBP/USD

Hunt Confirms Additional 2 Percent Cut to NI Contributions, No Tax Cut

There has been a large degree of political importance surrounding what is essentially a pre-election budget – with Jeremy Hunt given the near impossible task of appealing to the voter base and balancing the books at the same time.

In the lead up to the UK budget announcement a tax cut was widely anticipated until Jeremy Hunt, by his own admission, highlighted that forecasts ‘have gone against us’, leaving very little headroom for the Chancellor of the Exchequer to maneuver with.

Hunt announced increased duties on: vaping, air travel on non-economy class and scrapped tax breaks on holiday lets as well as abolishing multiple dwelling relief. He also reduced the higher rate of capital gains tax from 28% to 24%, extended the oil and gas windfall for another year and upped the child benefit threshold.

Looking at the general election poll tracker below, it is clear to see the Tory drop off during the brief Liz Truss’ government. At the same time, support for the Labour party grew and currently the gap appears insurmountable ahead of the general election to take place later this year.

Source: Financial Times

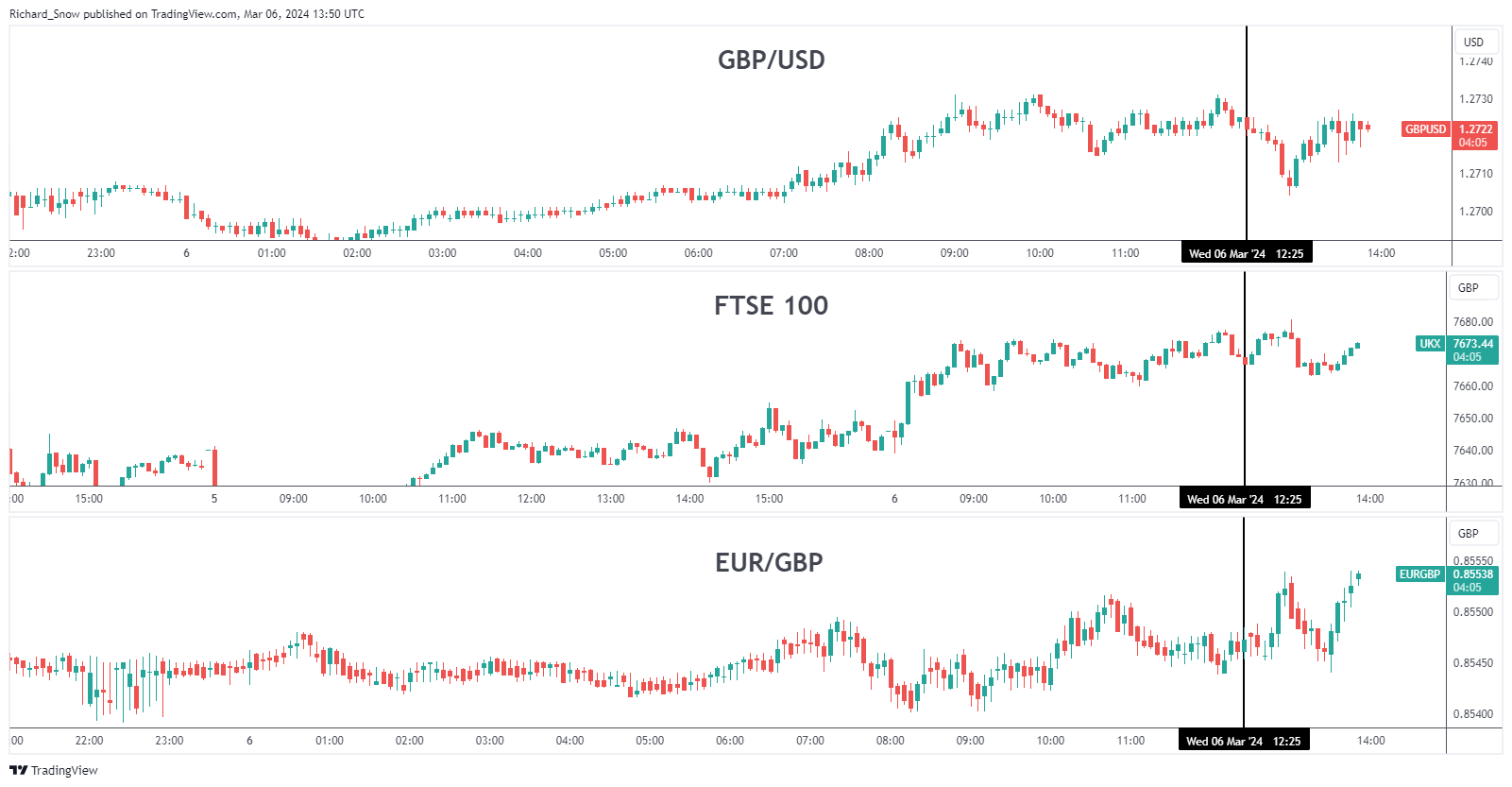

UK Asset Reaction (GBP/USD, FTSE 100, GBP/JPY)

UK assets were little changed throughout the duration of the speech, seeing a minor drop at the start which recovered to levels seen before the formalities got under way.

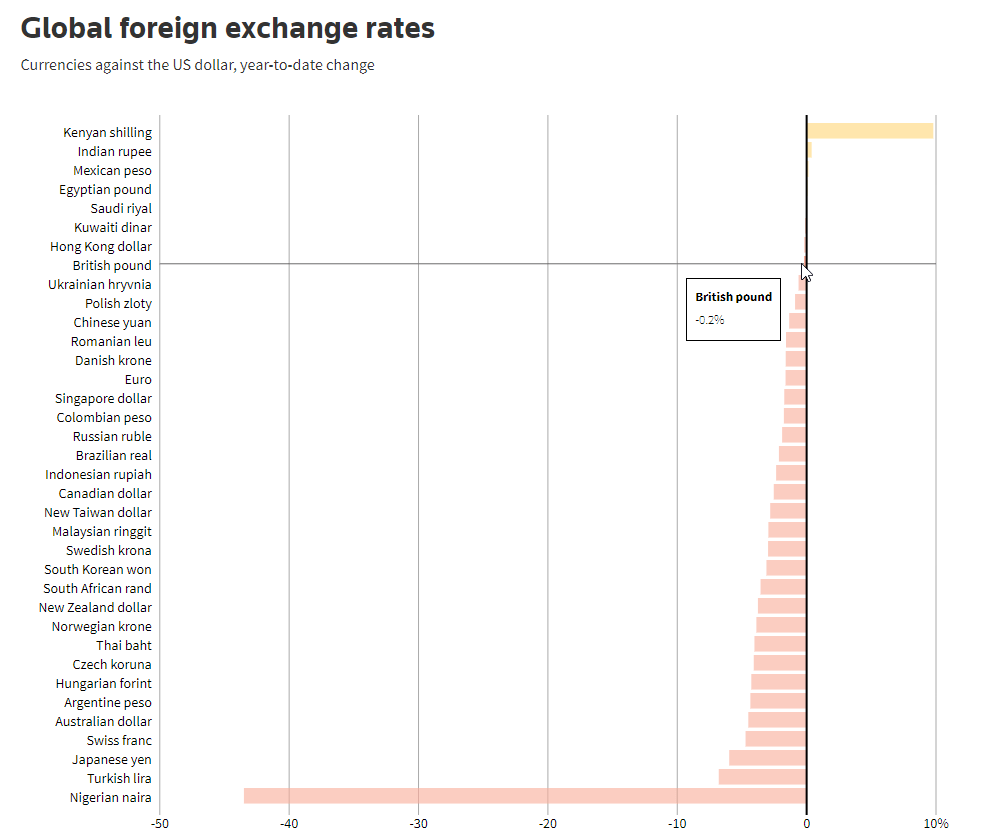

The British Pound is marginally negative against the dollar, year-to-date, but has enjoyed somewhat of a lift in the lead up to the Spring Statement, mainly due to softer US data. Tuesday’s services PMI data eased a tad, building on early concerns revealed in Friday’s manufacturing data that flagged the ‘new orders’ sub-index – a forward looking indicator. The Pound Sterling is among the top performers against the dollar this year so far and that is despite being down ever so slightly (-0.2%).

Source: Reuters, prepared by Richard Snow

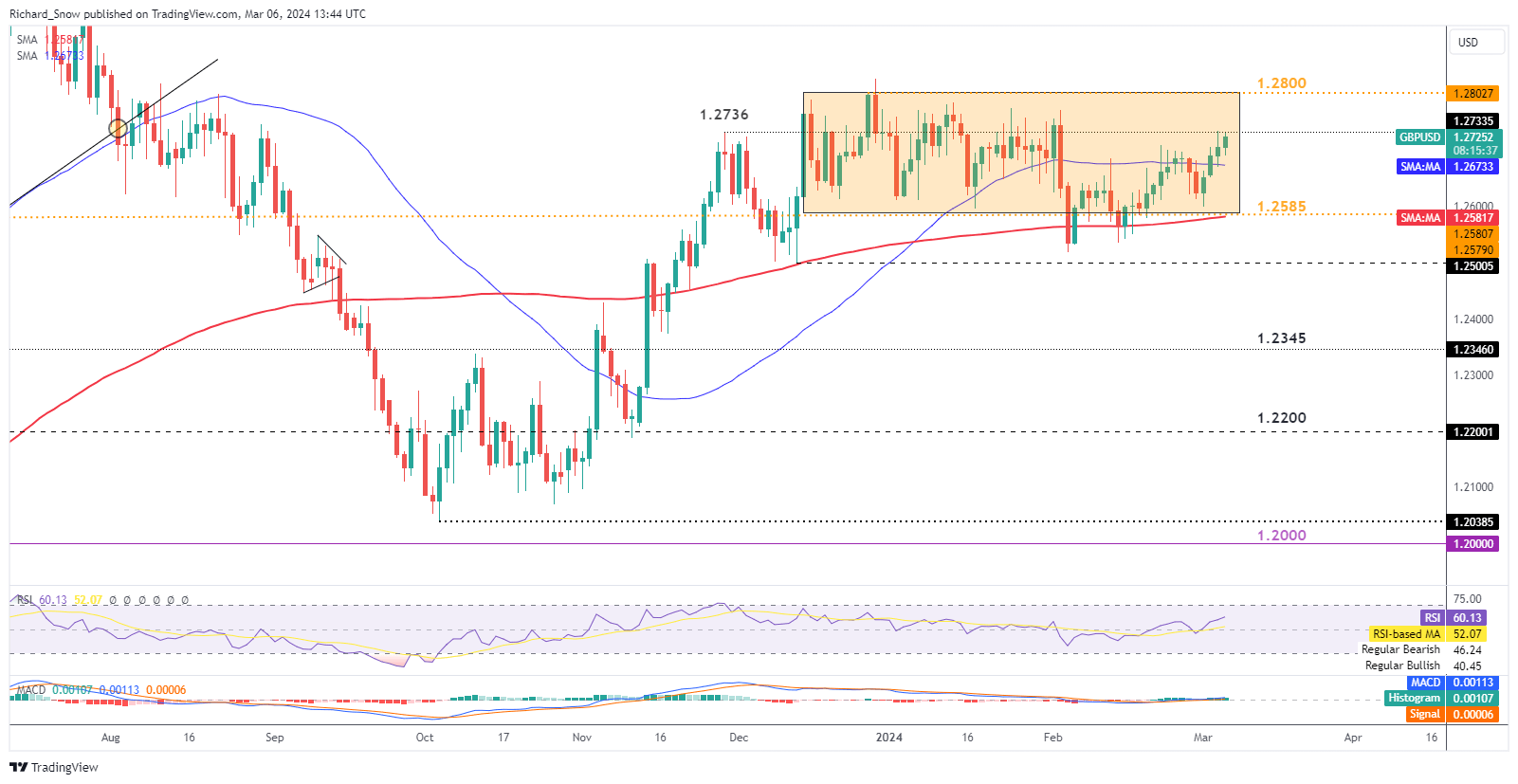

GBP/USD largely dependent on Powell, US jobs data this week

GBP/USD tests the November high around 1.2736, with channel resistance at 1.2800 in sight. The Bank of England is expected to hold interest rates until August which suggests its peers (Fed and ECB) will both cut before it, providing sterling with a slight edge when considering interest rate differentials.

The RSI is yet to approach overbought territory meaning if US jobs data comes in softer this week, GBP/USD could test channel resistance. On the other hand, if US jobs data beats estimates again, we could see cable pressure return, sending the pair towards channel support. Today and tomorrow also sees the Fed Chair Jerome Powell giving testimony in front of Congress with markets looking for any clues around rate cuts or general dovish sentiment from the head of the Fed.

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Leave a Reply