Gold (XAU), Oil (USOIL) Bitcoin (BTC) Technical Outlooks and Prices

- Gold looking to push ahead, higher US Treasury yields weigh for now.

- Oil breaks recent sell-off on fresh geopolitical concerns.

- Bitcoin prints a new 21-month high.

Download our Free Q1 2024 Gold Forecast Below

Recommended by Nick Cawley

Get Your Free Gold Forecast

For all economic data releases and events see the DailyFX Economic Calendar

A stronger US dollar is weighing on gold as we start the year but the overall outlook for the precious metal remains positive. The daily chart shows a series of unbroken higher lows and higher highs since early October, while all three simple moving averages remain in a bullish set-up. There is plenty of recent support back down to around $2,010/oz. while a break above the December 28th high of $2,088.5/oz. opens the way to the spike high of $2,146.8/oz.

Gold Daily Price Chart

Retail trader data shows 56.57% of traders are net-long with the ratio of traders long to short at 1.30 to 1.The number of traders net-long is 5.46% higher than yesterday and 6.39% lower than last week, while the number of traders net-short is 1.38% higher than yesterday and 7.14% higher than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall.

See how changes in IG Retail Trader data can affect sentiment and price action.

| Change in | Longs | Shorts | OI |

| Daily | 12% | 4% | 8% |

| Weekly | -2% | 4% | 1% |

Oil is picking up a geopolitical bid after Iran sent a warship to the Red Sea yesterday, stoking tensions further. The Red Sea is the southern entrance to the Suez Canal, a vital shipping lane. According to a Politico article, some 7 to 10 percent of the world’s oil and eight percent of LNG pass through these waters.

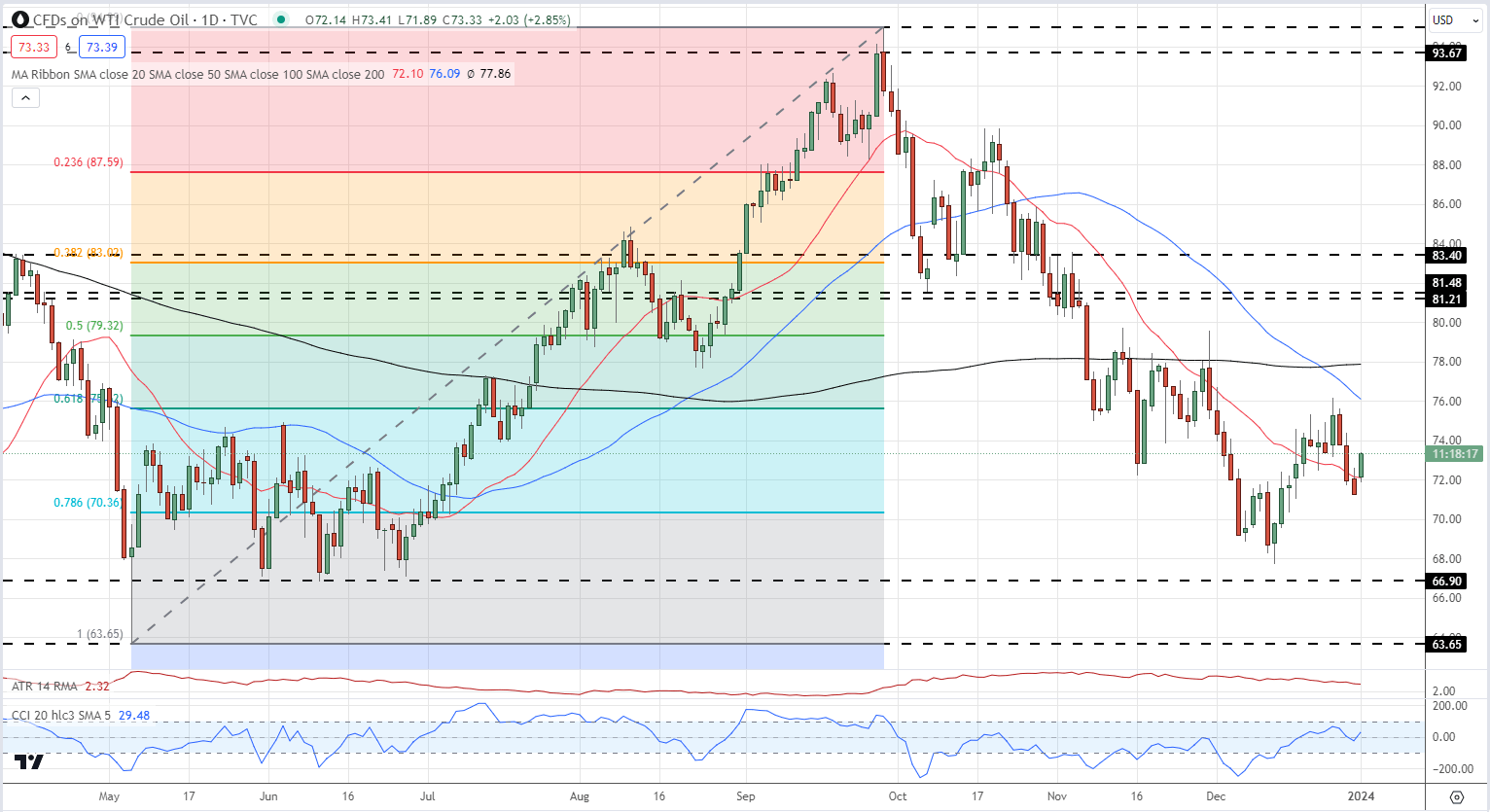

Oil is pushing higher today, after pushing lower at the end of December. The daily chart looks mixed with a print below $67.74/bbl. needed to keep a series of lower lows intact, while the current spot price ($73/bbl.) is using the 20-dsma as current support. A bearish 50-/200-dsma crossover was made on December 22nd. Initial support off the 78.6% Fibonacci retracement at $70.36/bbl. before a triple low of around $67/bbl. comes into play.

US Oil Daily Chart

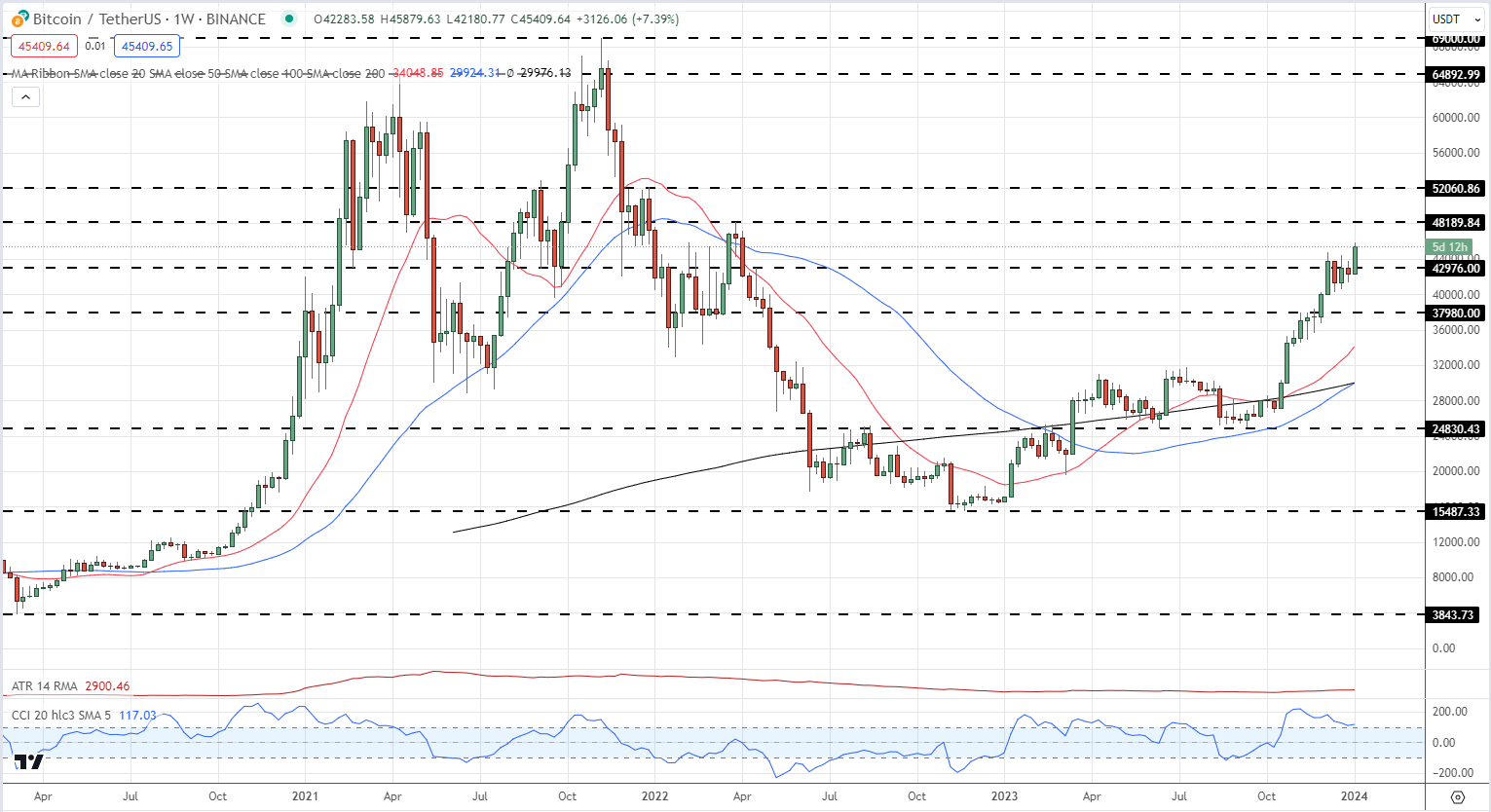

Bitcoin rallied strongly last year and is continuing to push higher in 2024. Growing expectations of SEC approval for a raft of spot Bitcoin ETF and longer-term traders setting up ahead of the next Bitcoin halving in April have underpinned the rally and pushed Bitcoin to its highest level since April last year.

Bitcoin Q1 Fundamental Outlook – Positive Tailwinds

The weekly chart shows the next level of resistance just under $48.2k before the December 2021 triple top around $52k comes into play.

Bitcoin Weekly Chart

All Charts via TradingView

What is your view on Gold, Oil, and Bitcoin – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Leave a Reply