GBP PRICE, CHARTS AND ANALYSIS:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Read More: USD/CAD Price Forecast: Acceptance Above 1.3650 Needed for Bullish Continuation

GBP, BoE AND INFLATION

GBP has been on an interesting trajectory of late with gains against both the Euro and Aussie Dollar while losing ground against the Greenback. This has come against a backdrop of rising expectations of further rate hikes from the Bank of England (BoE) with money markets pricing in around 100bps of hikes by November. Such a move would bring the rate up to 5.5% and likely similar to that of the US Federal Reserve. Further strengthening this narrative was yesterday’s data from the British Retail Consortium with the shop price inflation rising to its highest rate since records began in 2005 coming in at 9%. This will add to the market’s expectations for a more hawkish BoE as it presents signs that inflation may remain sticky moving forward.

Bank of England Rate Hike Probabilities

Source: Refinitiv

On the back of this the GBP has remained largely supported against its peers with losses against the US Dollar down to US dollar dynamics. The US dollar has also benefitted of late from hawkish repricing of the Fed Rate Hike expectation for its upcoming June meeting and beyond.

Taking a brief look at the Australian Dollar (AUD) and Euro both of which have lost ground to the GBP of late. The Aussie Dollar has continued its struggles of late with lackluster data out of China this morning compounding its woes.

Discover what kind of forex trader you are

PRICE ACTION AND POTENTIAL SETUPS

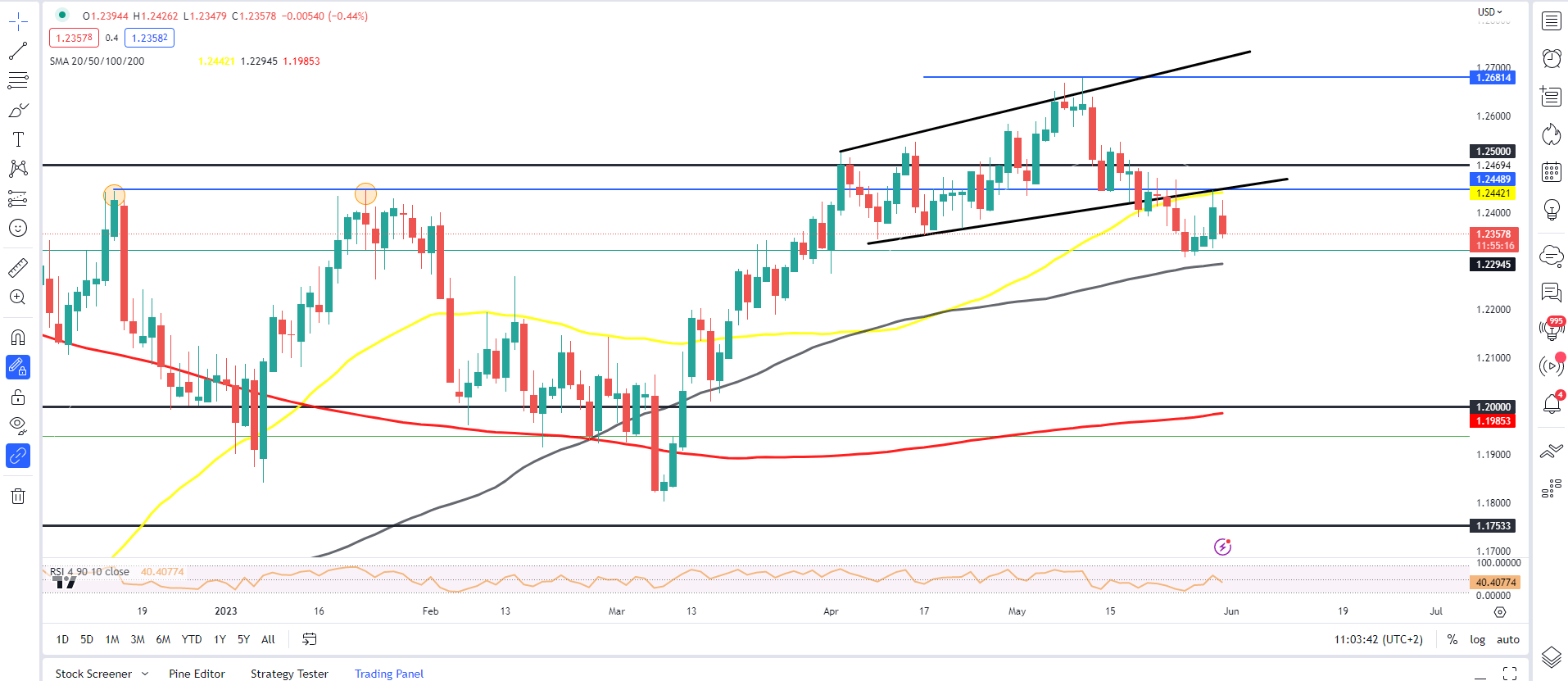

GBPUSD

GBP/USD Daily Chart

Source: TradingView, Prepared by Zain Vawda

GBPUSD put in a decent upside rally yesterday which ran into the 50-day MA and the lower end of the channel before a pullback. Overnight and the early part of the European session has resulted in further downside for Cable as the Dollar Index (DXY) continues to drive price movements.

Yesterday’s rejection of resistance around 1.2445 opens up the possibility of a test of the 100-day MA resting around the 1.2300 level. A push below this in my opinion might require a further catalyst such as the NFP and jobs data due out of the US on Friday. A positive release could further enhance the US dollar and thus lead to further downside.

Key Levels to Keep an Eye On:

Support levels:

- 1.2294 (100-day MA)

- 1.2250

- 1.2200

Resistance levels:

- 1.2445 (50-day MA)

- 1.2500 (psychological level)

- 1.2550

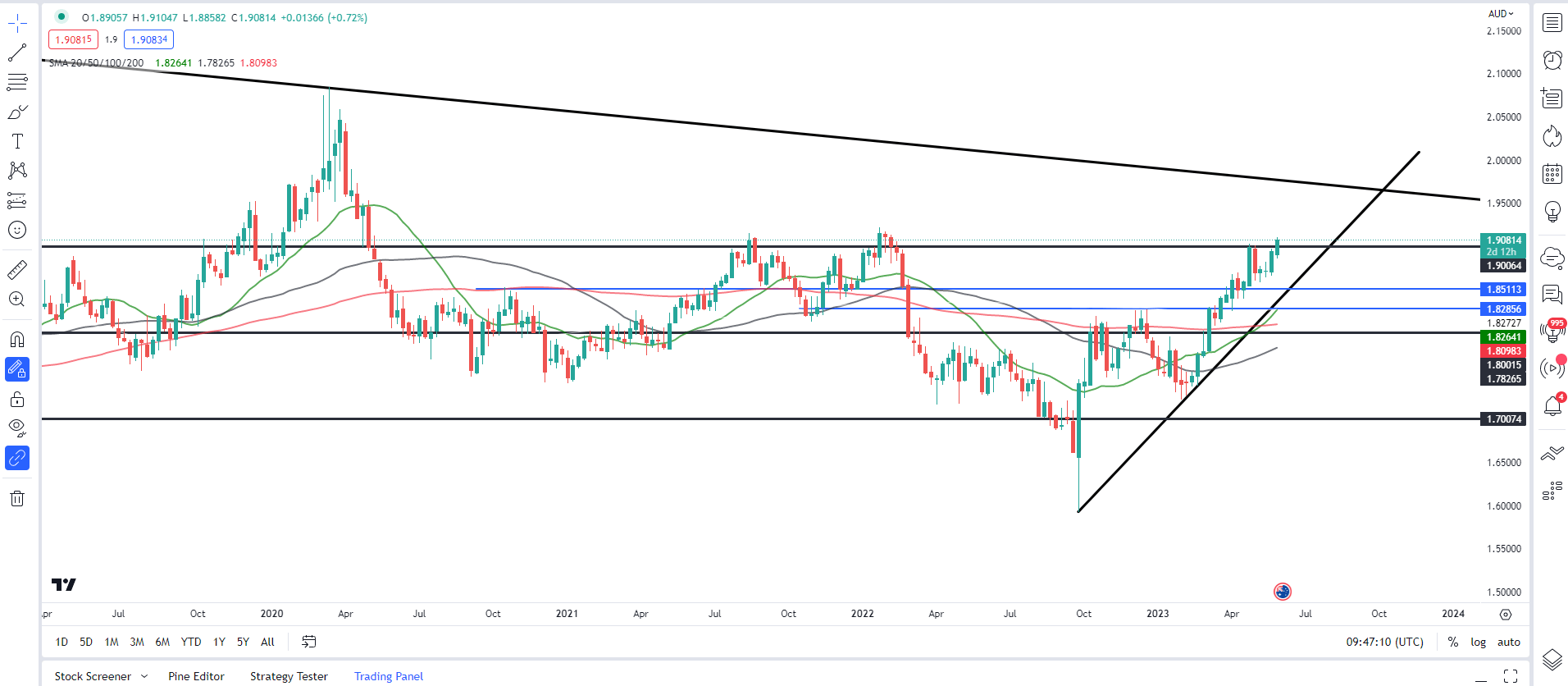

GBPAUD

GBP/AUD Weekly Chart

Source: TradingView, Prepared by Zain Vawda

From a technical perspective, the weekly chart for GBPAUD provides a better indication of price action as the pair has been staircasing its way higher since bottoming out in September 2022. Personally, I had been hoping for a third touch of the ascending trendline, however we haven’t seen a deep enough retracement as of yet.

This morning GBPAUD printed a fresh high with a daily close yesterday above the psychological 1.9000 mark. Immediate resistance rests around the 1.9220 handle (January 2022 swing high) before the long-term descending trendline around the 1.9500 handle may come into play. The 50-day MA has crossed above the 200-day MA in a golden cross pattern further hinting at the upside momentum in play. The only apprehension I would have is that we have just printed a fresh high which means a short-term pullback to immediate support around the 1.8930 handle.

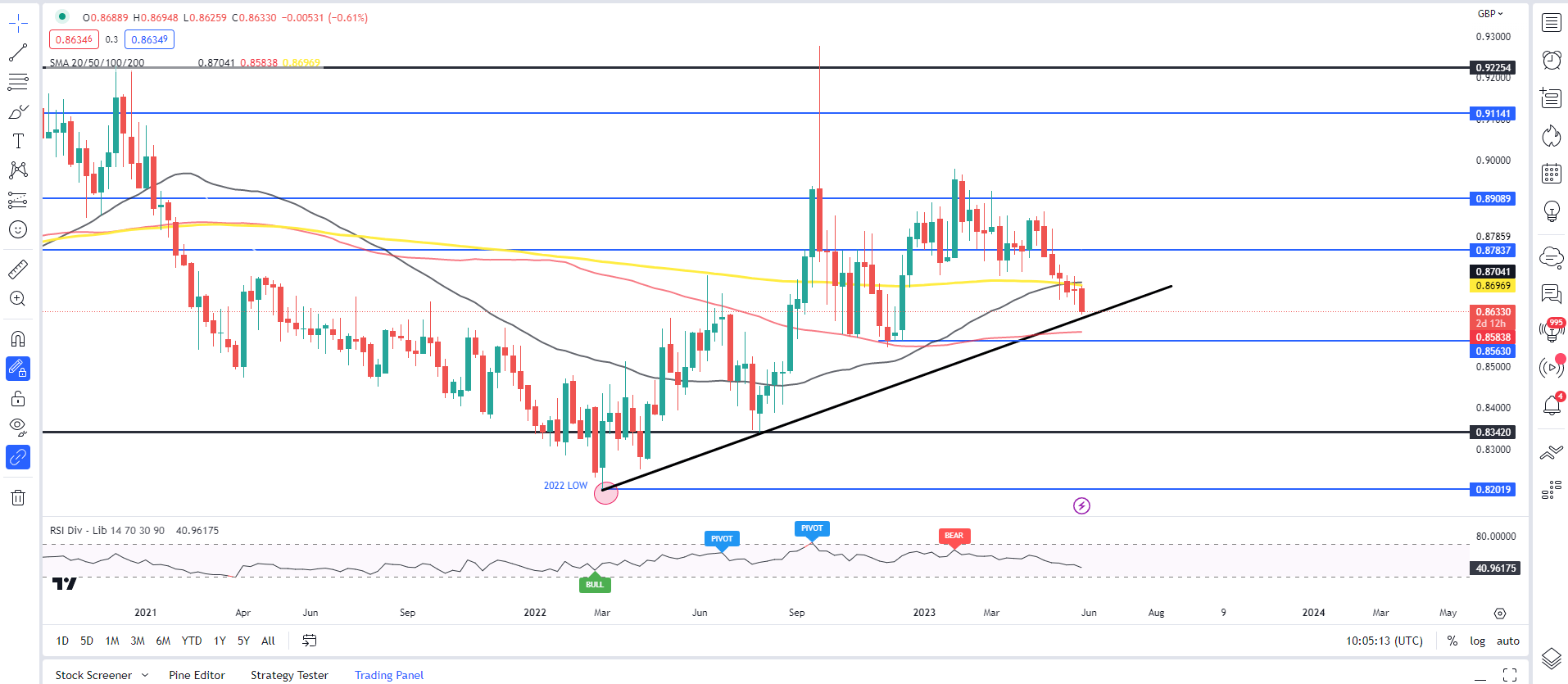

EURGBP

EUR/GBP Weekly Chart

Source: TradingView, Prepared by Zain Vawda

EURGBP on the weekly chart above is approaching a key confluence area. We have the ascending trendline, 100-day MA and the November 2022 swing low all providing support around the 0.8620-0.8580 handles with a bullish continuation definitely a possibility.

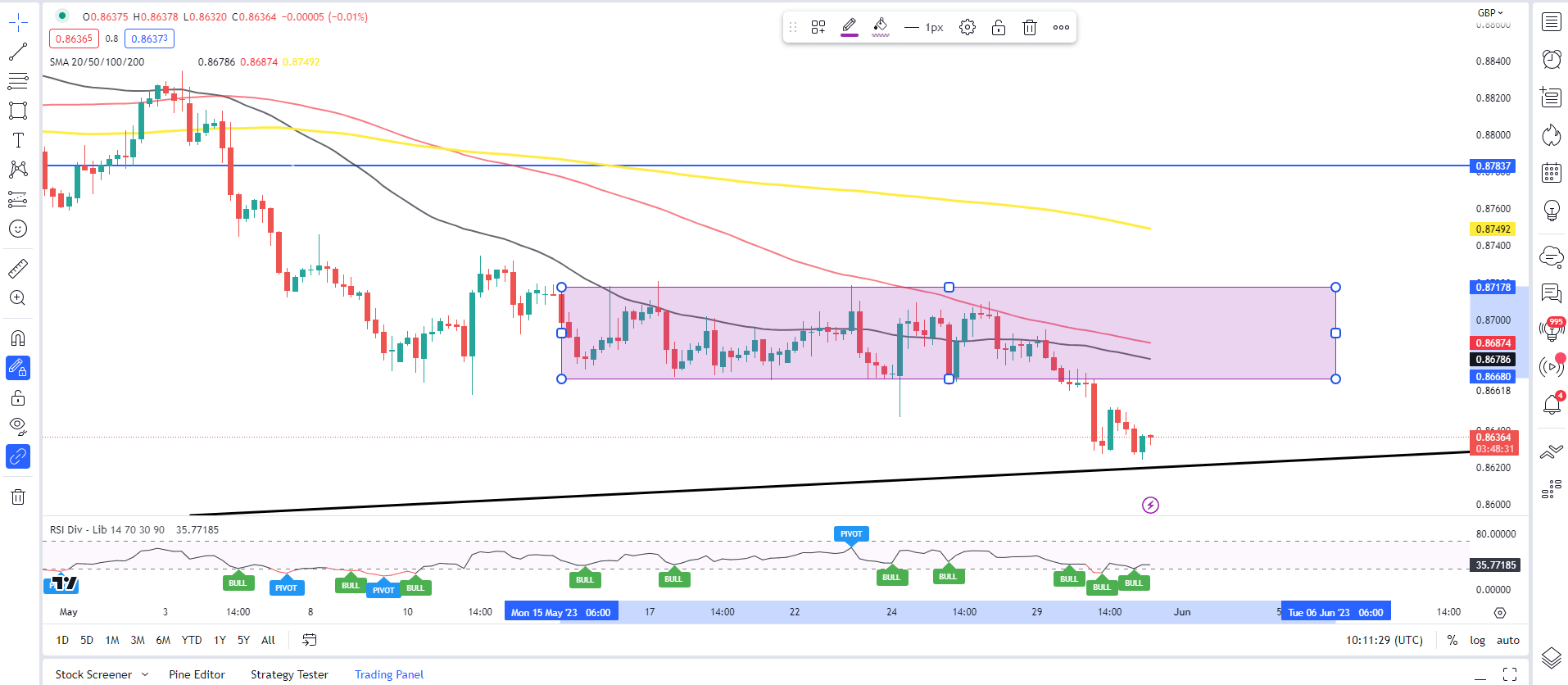

EUR/GBP 4H Chart

Source: TradingView, Prepared by Zain Vawda

Dropping down to a smaller timeframe and we can see that we are within touching distance of the ascending trendline. A bounce of trendline will find immediate resistance around the 0.8668 with the 50 and 100-day MA resting slightly higher.

Alternatively, a 4H or daily candle close below the trendline and support at 0.8580 could facilitate further downside with support around the 0.8500 handle coming into focus.

Introduction to Technical Analysis

Time Frame Analysis

Recommended by Zain Vawda

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Leave a Reply