GBP PRICE, CHARTS AND ANALYSIS:

Recommended by Zain Vawda

Get Your Free GBP Forecast

Read More: EUR/USD Eyes Short-Term Retracement as DXY Runs Into Confluence Area

GBP has struggled over the past few weeks since retreating from recent highs. The GBPUSD and EURGBP have remained rangebound as market participants remain unclear on the Bank of England’s (BoE) path moving forward.

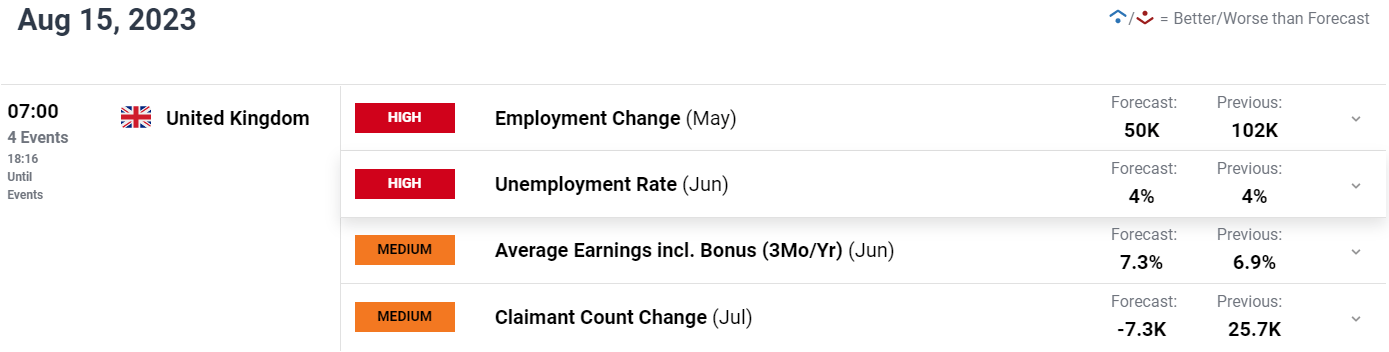

UK DATA AHEAD COULD PROVE PIVOTAL FOR THE GBP

Last week saw the UK economy deliver upbeat data in the form of GDP which beat estimates and once more underlined the strength of the economy. The Bank of England for its part has remained hawkish to a degree but have continually reiterated their belief that inflation would fall sharply in Q3 and Q4 of 2023. Heading into this week, markets are a bit divided following the positive GDP print last week with a Reuters poll revealing analysts believe Core inflation will drop by 0.1% but headline could remain an issue.

Source: DailyFX

Another key area which has plagued the BoE comes in the form if wage growth data in the UK. An upside surprise here could add further pressure on the BoE particularly if we do not see headline inflation fall as well. Service inflation could also factor in, however given that the end of summer is upon us this figure could be inflated due to Tourist and Visitors to London during the summer months.

For a Full Breakdown on Trading Range Breakouts, Get Your Free Guide Below

Recommended by Zain Vawda

The Fundamentals of Breakout Trading

Given that consolidation has been a theme for the majority of the month it may be worth pointing out that August has historically been a pretty choppy trading month. There is a possibility that GBPUSD and EURGBP remain rangebound or if there is a breakout following data releases this could prove to be short lived.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

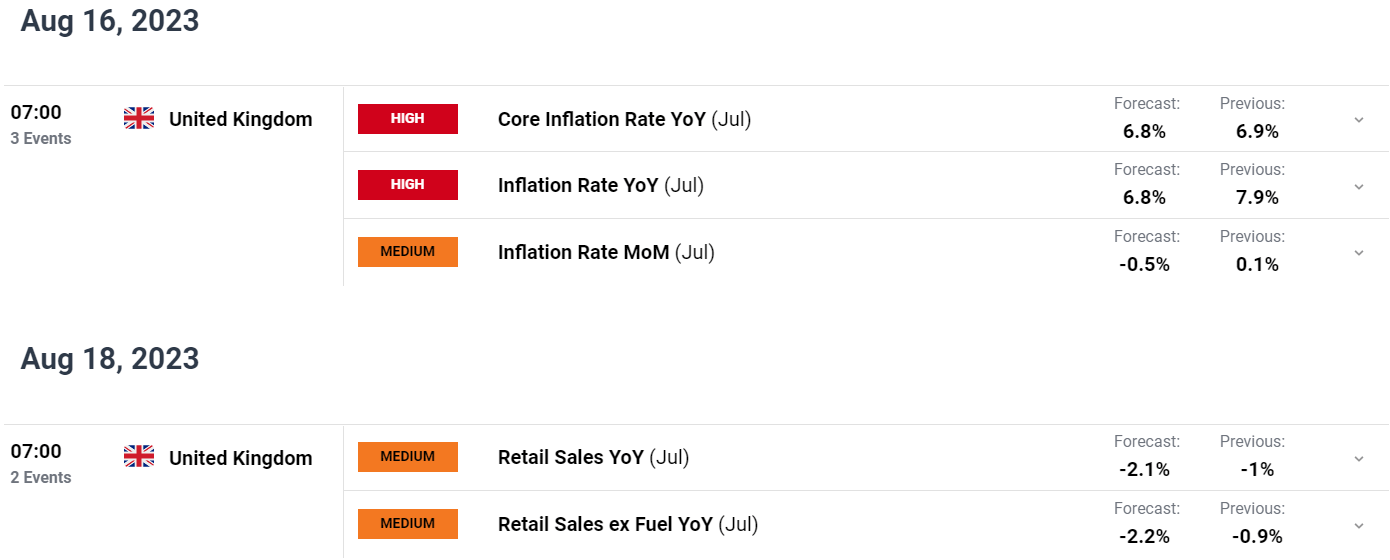

GBPUSD has been ticking lower since the fresh YTD high on July 13 as price remains compressed between the 1.2677 (50-day MA) and the 100-day MA around the 1.26120 mark. GBPUSD attempted a break on the positive GDP data last week but failed to hold onto gains, a theme which seems to be dominating market moves of late.

Looking ahead we are yet to see a retracement toward the 1.2500 psychological level which grows more likely the longer we consolidate between the MAs.

Let’s take a look at what client sentiment is telling us with 56% of traders currently hold long positions. At DailyFX we typically take a contrarian view to crowd sentiment which means GBPUSD may continue lower following a brief bounce higher.

Key Levels to Keep an Eye On:

Support levels:

- 1.2680

- 1.2620 (100-day MA)

- 1.2500

Resistance levels:

- 1.2700

- 1.2850

- 1.3000 (psychological level)

GBP/USD Daily Chart

Source: TradingView, Prepared by Zain Vawda

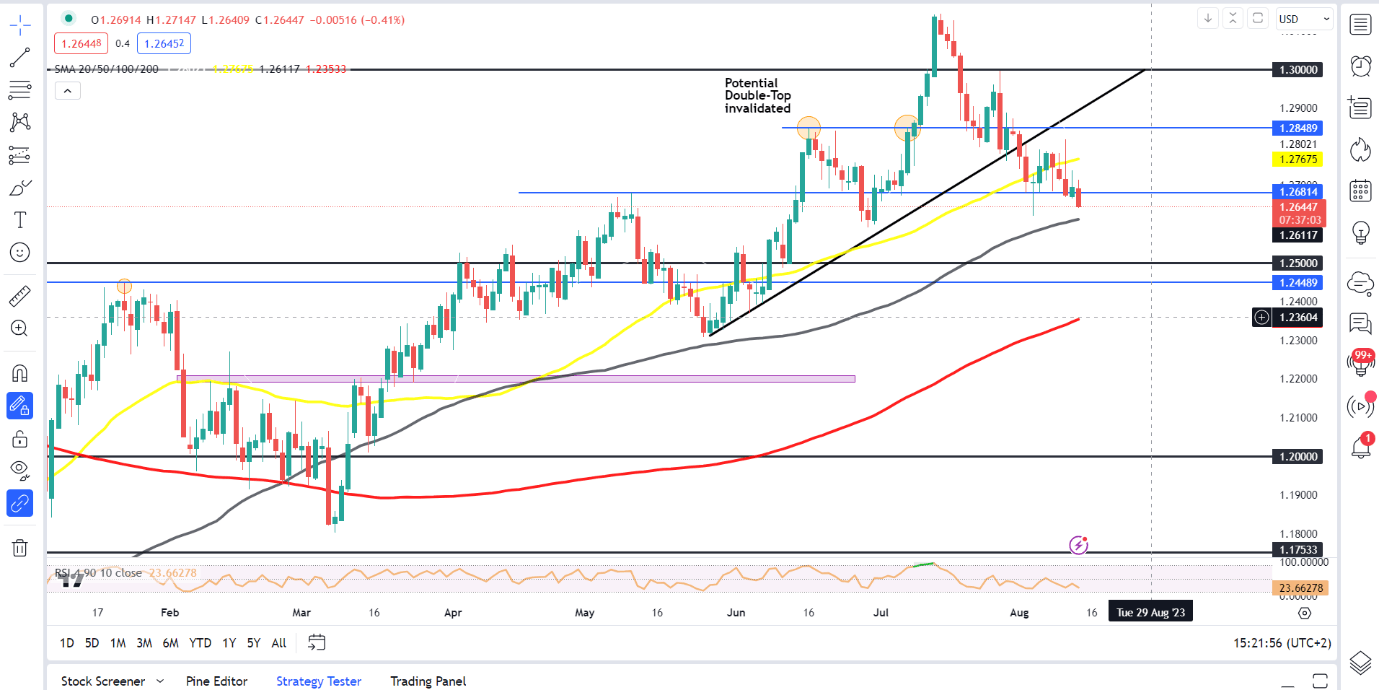

EURGBP

EURGBP on the other hand has been ticking slightly higher of late but also remains within a rising wedge pattern. The move which started around the same time GBPUSD began its move lower is testament to the fact that the GBP was the major player behind the initial decline and ensuing consolidation.

Given the differing paths of the two economies as well as their respective battles against inflation its is premature to discuss a potential breakout. UK data this week in my humble opinion is unlikely to inspire a breakout on a pair whose moves are generally pretty small in comparison to GBPUSD.

As EURGBP pushes toward the bottom end of the wedge pattern there is significant support there which could inspire a short-term recovery. The 50-day MA lines up perfectly with the bottom end of the wedge pattern as well adding a further confluence, while a break of the range opens the door for a test of the July lows around 0.8500.

A push higher here faces resistance at the 100-day MA around 0.8666 which rests below the top of the wedge pattern. A break above the wedge pattern may finally see a retest of the 200-day MA which has not occurred since early May.

EUR/GBP Daily Chart

Source: TradingView, Prepared by Zain Vawda

IG CLIENT SENTIMENT DATA

IG Retail Trader Sentiment shows that 61% of traders are currently NET LONG on EURGBP. The ratio of long to short is 1.56 to 1.

For a more in-depth look at EUR/GBP sentiment and the changes in long and short positioning, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 12% | 7% | 10% |

| Weekly | 5% | -8% | 0% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Leave a Reply