CRUDE OIL ANALYSIS & TALKING POINTS

- Global economic growth and USD variables play tug of war with oil markets.

- US CPI and FOMC the focal points for the week ahead.

- Crude oil prices anticipate fundamental guidance.

Recommended by Warren Venketas

Get Your Free Oil Forecast

CRUDE OIL WEEKLY FORECAST: MIXED

Crude oil ended the week relatively flat while trading in a rangebound manner due to the low volatility throughout the week. The upcoming week holds several high impact US economic releases that is likely to bring back excitement to global markets. Despite Saudi Arabia’s announcement to cut production by an additional 1 million barrels per day (bpd), oil prices haven’t really kicked on from there. Misinformation around the US and Iran potentially reaching a deal that could bring in added supply was swiftly dismissed by the White House providing some short-term support for oil.

The hesitancy in markets stems from the possibility that higher US inflation via the CPI report (refer to economic calendar below) could lead to another Federal Reserve interest rate hike. Unexpected hikes by two developed nations (Australia and Canada) have added to the hawkish narrative; however, money markets remain in favor of a rate pause.

From a USD perspective, the greenback has been on the backfoot but if inflation continues to decline, crude oil prices may gain some traction. Growing global recessionary fears remain a shadow over demand forecasts and major economies releasing key economic data, I will be closely monitoring these data inputs to gain a clearer image of the global economy and whether incoming data heightens or dampens slowdown concerns.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

Foundational Trading Knowledge

Commodities Trading

Recommended by Warren Venketas

TECHNICAL ANALYSIS

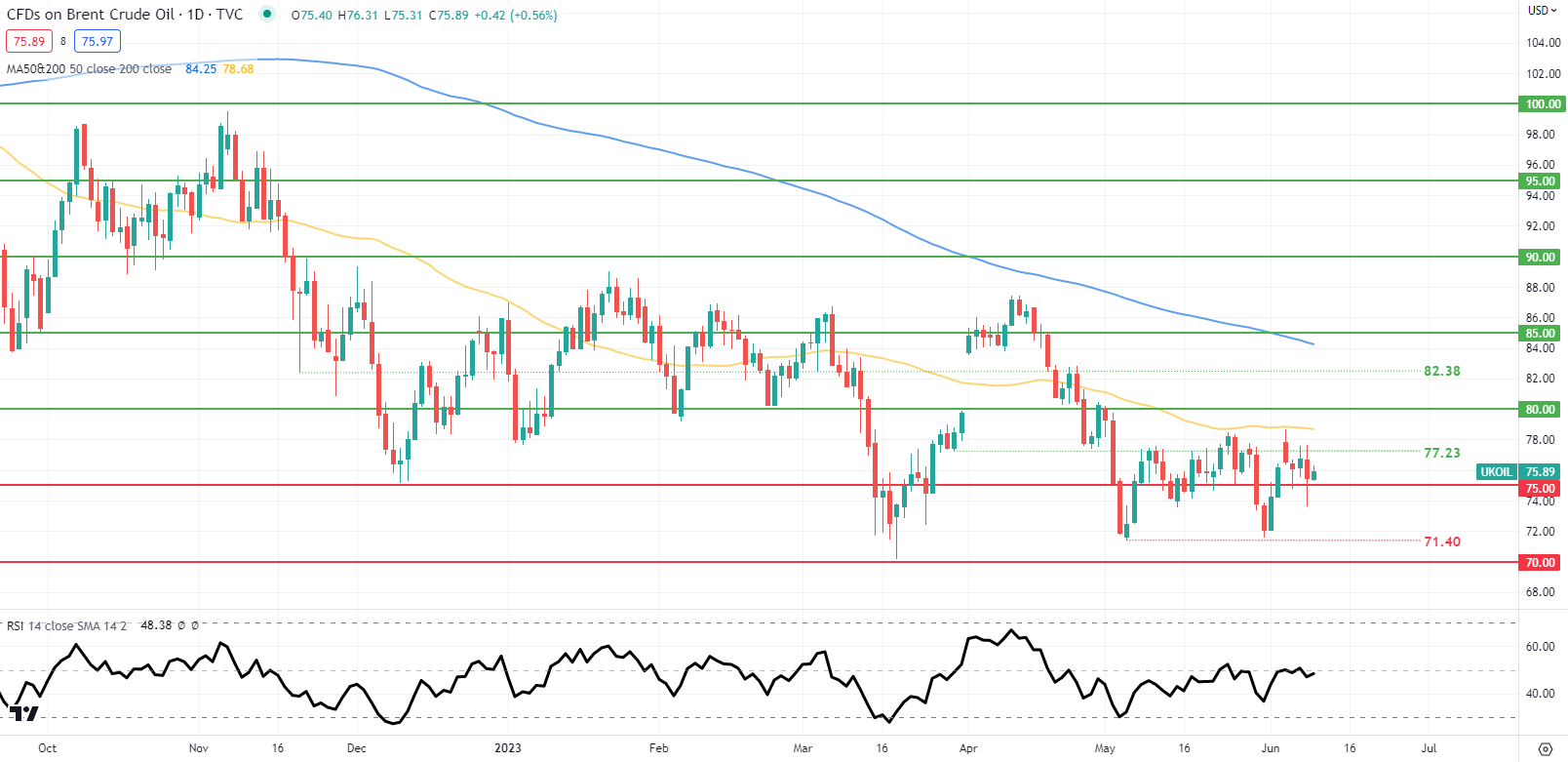

BRENT CRUDE (LCOc1) DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily Brent crude chart above shows the recent consolidatory progression around the 75.00 psychological handle. The Relative Strength Index (RSI) supplements market hesitancy with a reading around the 50 level.

Key resistance levels:

- $80.00

- 50-day MA (yellow)

- $77.23

Key support levels:

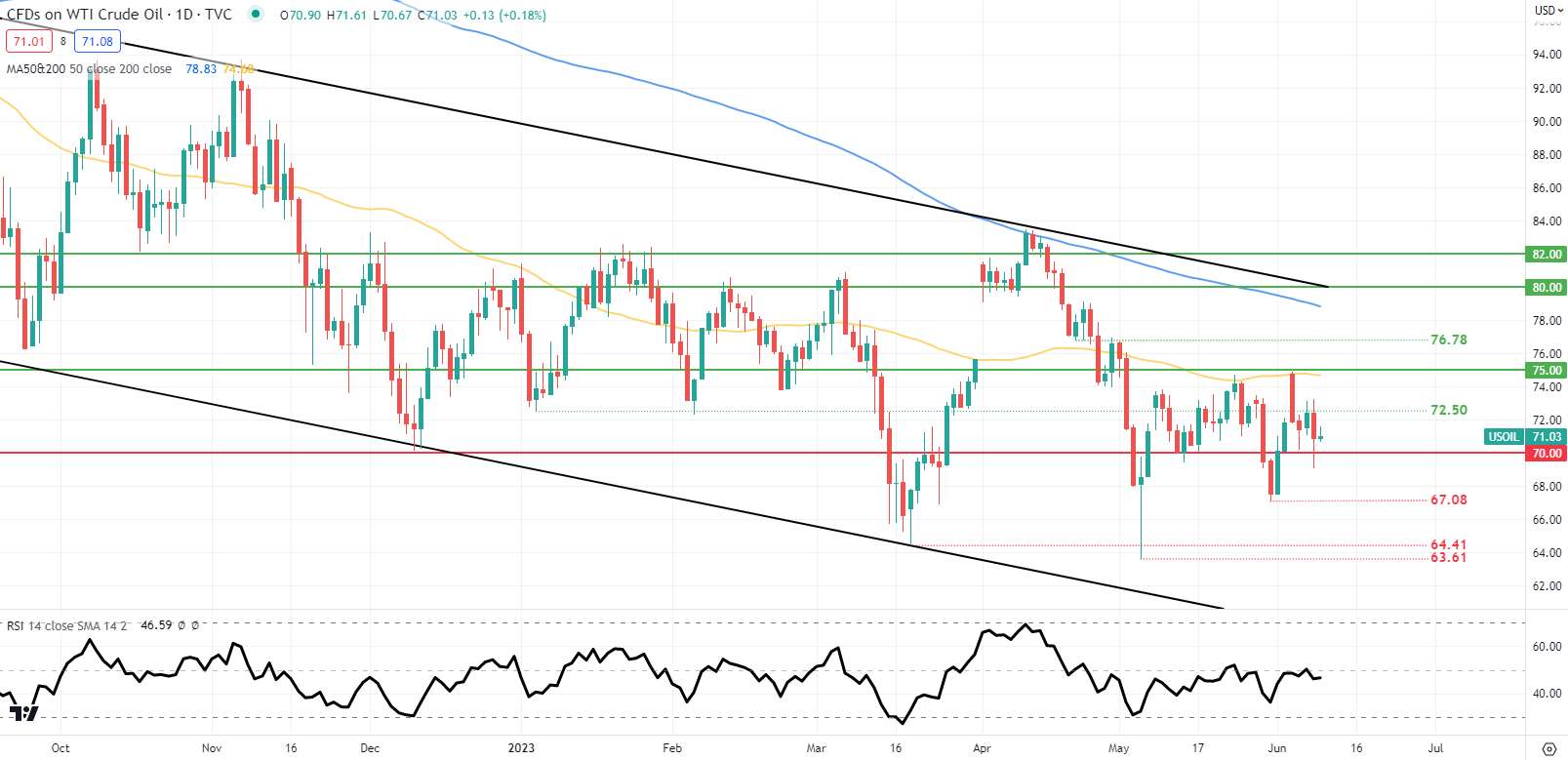

WTI CRUDE (CLc1) DAILY CHART

Chart prepared by Warren Venketas, IG

Key resistance levels:

- $75.00/50-day MA (yellow)

- $72.50

Key support levels:

IG CLIENT SENTIMENT: MIXED

IGCS shows retail traders are NET LONG on Crude Oil, with 80% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment; however, due to recent changes in long and short positioning we arrive at a short-term cautious disposition.

Contact and followWarrenon Twitter:@WVenketas

Leave a Reply