POUND STERLING ANALYSIS & TALKING POINTS

- US debt ceiling optimism unable to sustain high flying pound.

- BoE and Fed speakers in focus.

- GBP/USD on the backfoot but technical show hesitancy to commit to one direction.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBPUSD FUNDAMENTAL BACKDROP

The British pound has not managed to pounce on US debt ceiling optimism as with many G10 currencies as investors remain in the ‘cautious’ camp. Sticking with the safe haven USD for now, the Dollar Index (DXY) is trading in the green this Thursday morning. All in all, with President Joe Biden cutting his Asia/Pacific trip short, House Speaker for the US Representatives Kevin McCarthy stated that reaching a deal is doable. That being said, until such time as markets are given more actionable and structured insights into the deal negotiations, I forecast the greenback will continue to be preferred.

Bank of England (BoE) interest rate expectations has not really changed much this week with the peak rate still hovering around 42bps for 2023 (refer to table below). We could see some short-term price volatility later this morning as the BoE’s Chief Economist Huw Pill and Governor Andrew Bailey are scheduled to give their comments. Governor Bailey acknowledged the wage-price concern and mentioned raising rates where necessary to bring down inflation. Further hawkish remarks today could support the pound in this risk averse environment.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Source: Refinitiv

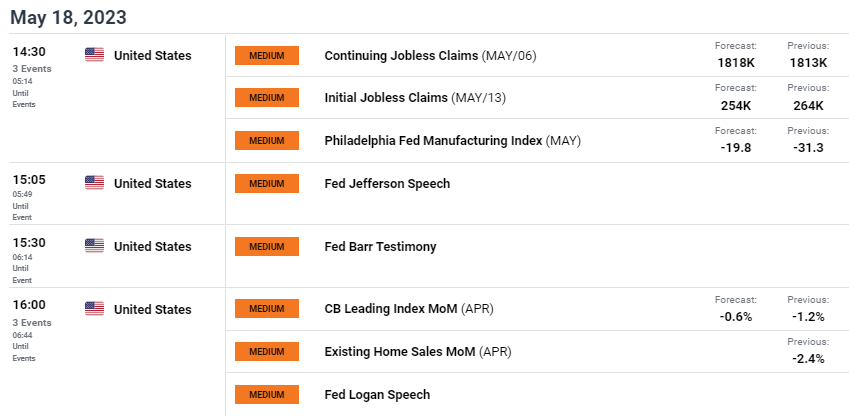

The economic calendar today is dominated by US economic data and Fed speak with the focus on jobless claims data.

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

TECHNICAL ANALYSIS

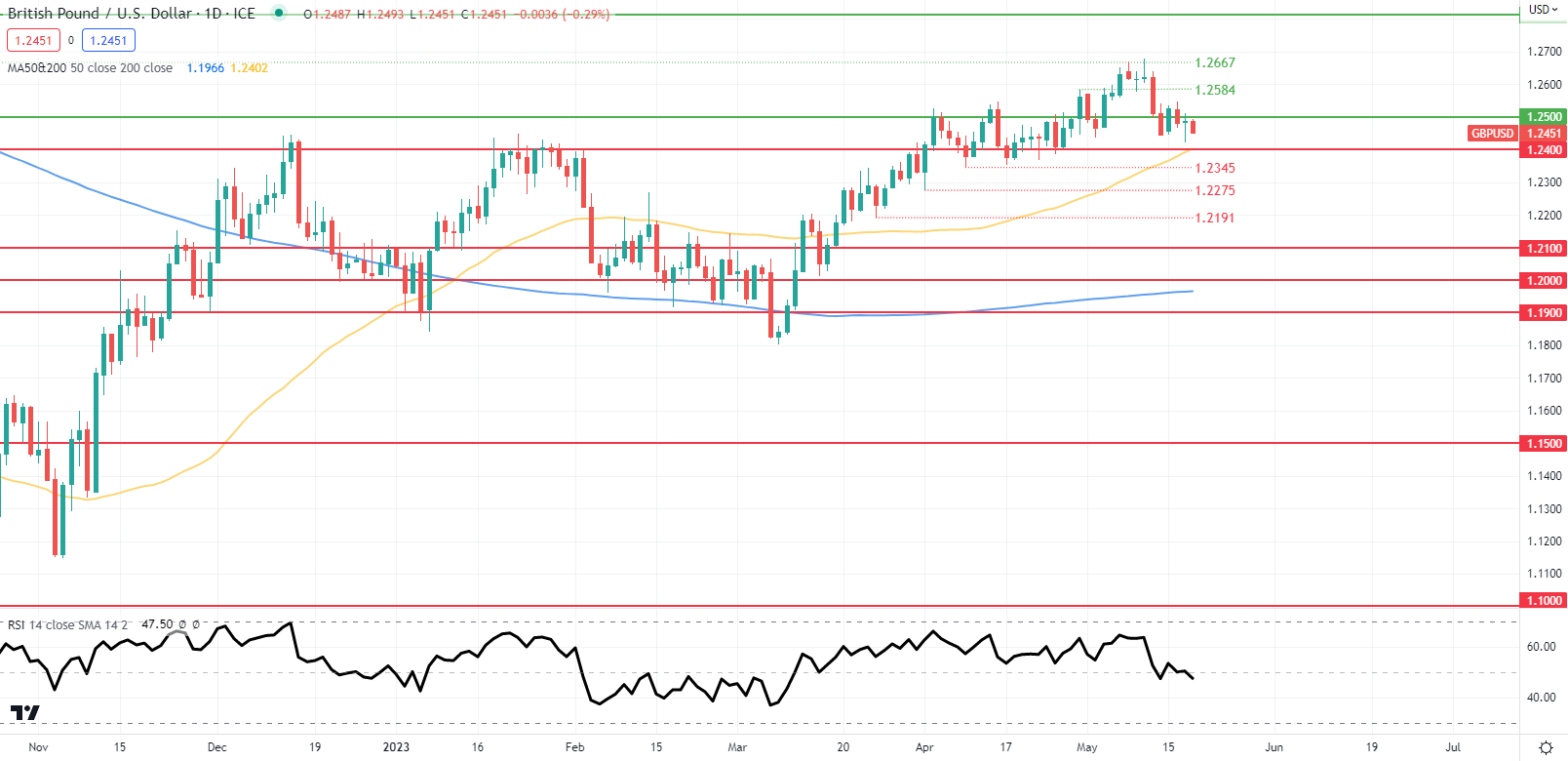

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily GBP/USD price action now sees bears eyeing the 50-day moving average (yellow) coinciding with the 1.2400 psychological support handle. This key area of confluence may hold but a daily candle close below this level could be triggered by negative US debt ceiling reports.

The Relative Strength Index (RSI) has now dipped below the midpoint 50 level, marginally pushing the pairs momentum into bearish territory.

Key resistance levels:

Key support levels:

- 1.2400/50-day MA (yellow)

- 1.2345

- 1.2275

MIXED IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently neither net LONG or SHORT on GBP/USD with 50% of traders net long and net short (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term cautious disposition.

Contact and followWarrenon Twitter:@WVenketas

Leave a Reply