Bitcoin (BTC), Ethereum (ETH) Prices, Charts, and Analysis:

- Bitcoin back at highs last seen in November 2021.

- Coinbase, Robinhood, MicroStrategy surge on renewed cryptocurrency interest.

Recommended by Nick Cawley

Get Your Free Introduction To Cryptocurrency Trading

Bitcoin continues its strong run higher as ongoing ETF buying and the upcoming halving event in mid-April fuel heavy buying. On January 10th, eleven spot Bitcoin ETFs were approved by the SEC, opening the door to a wide range of customers. Since mid-January one Bitcoin ETF, run by BlackRock, has already seen over $6.6 billion of inflows, helping to send the price of Bitcoin spiraling higher. On January 10th, Bitcoin opened at $46k compared to a current spot price of around $56.5k. With demand high, traders are looking at the upcoming Bitcoin halving, expected in mid-April, as the next driver of price action as block rewards are cut from 6.25 to 3.125, reducing supply.

The Next Bitcoin Halving Event – What Does it Mean?

The weekly chart shows BTC breaking above a recent period of consolidation around $52k and pushing higher. There is minor resistance from a couple of October 2021 prior highs around the $59.5k level before the $65k area comes into focus. As always with any cryptocurrency, care should be taken as sharp swings and volatile market conditions are to be expected.

Bitcoin Weekly Price Chart

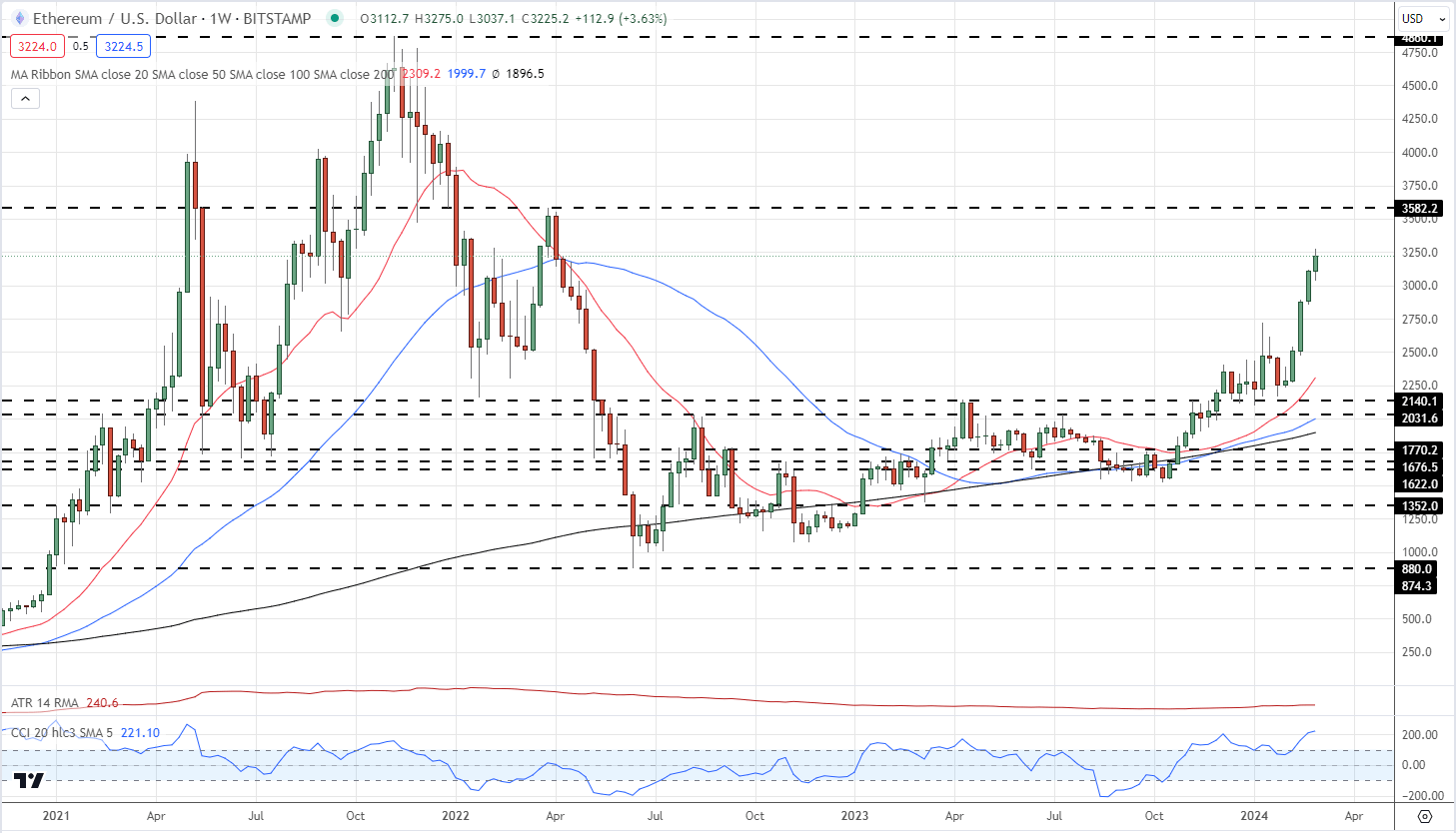

Ethereum is moving higher aided by the strong Bitcoin tailwind and growing market belief that spot Ethereum ETFs may be approved at the end of May. While the May 23rd approval deadline for the VanEck ETF is seen as the key date to watch, there is still the possibility that the SEC will not approve this application, a decision that could send Ethereum sharply lower.

Ethereum Spot ETF – The Next Cab Off the Rank?

The next level of interest for Ethereum bulls is the late-March 2022 high at $3,582, a level just 10% away from the current spot price.

Ethereum Weekly Price Chart

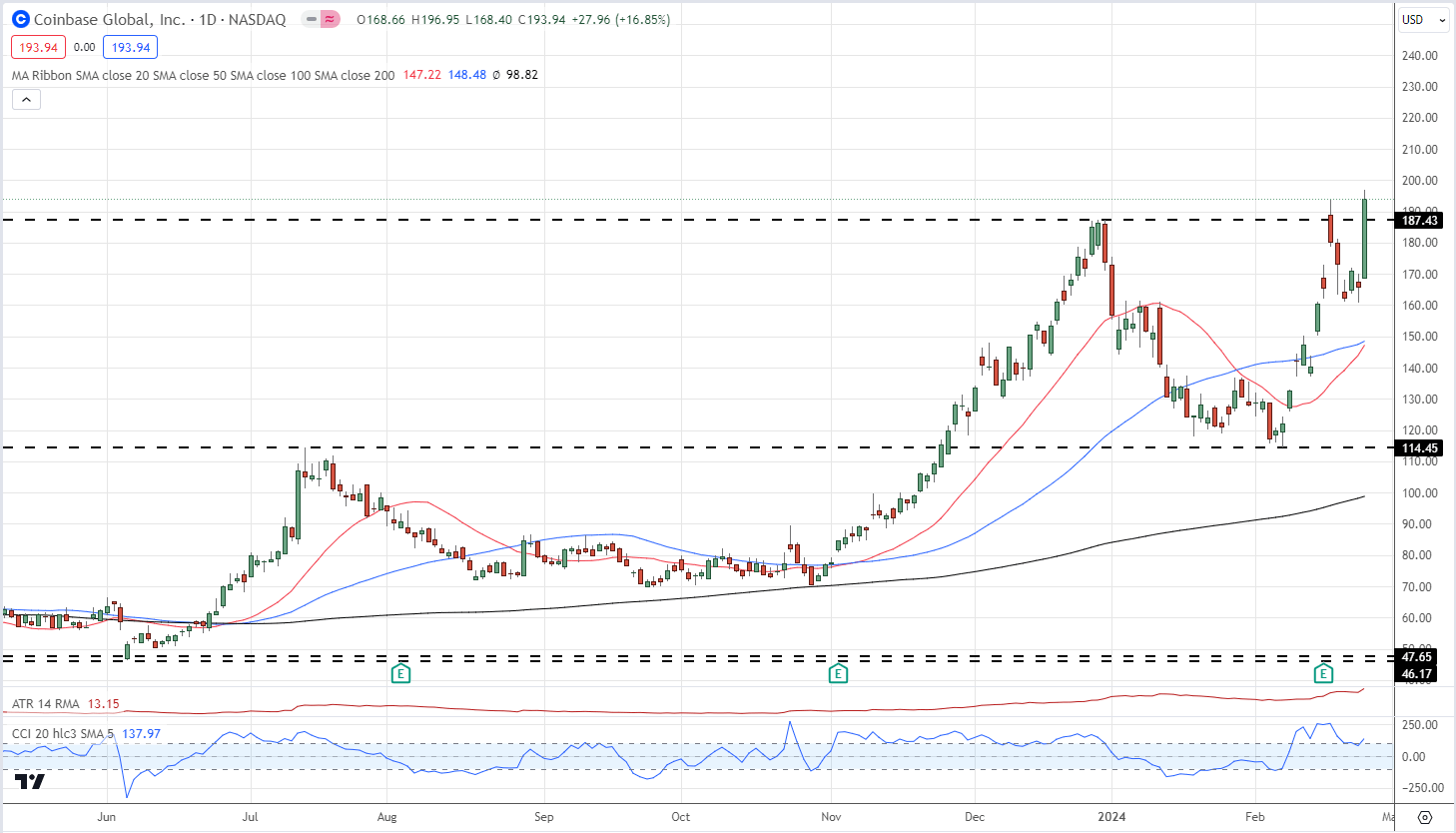

Crypto-related stocks put in a very strong performance yesterday with some seeing double-digit gains.

Crypto-currency exchange, Coinbase (COIN) broke above a multi-month high and ended the session 16.9% higher at a fraction under $194.

Coinbase (COIN) Daily Chart

Recommended by Nick Cawley

Get Your Free Top Trading Opportunities Forecast

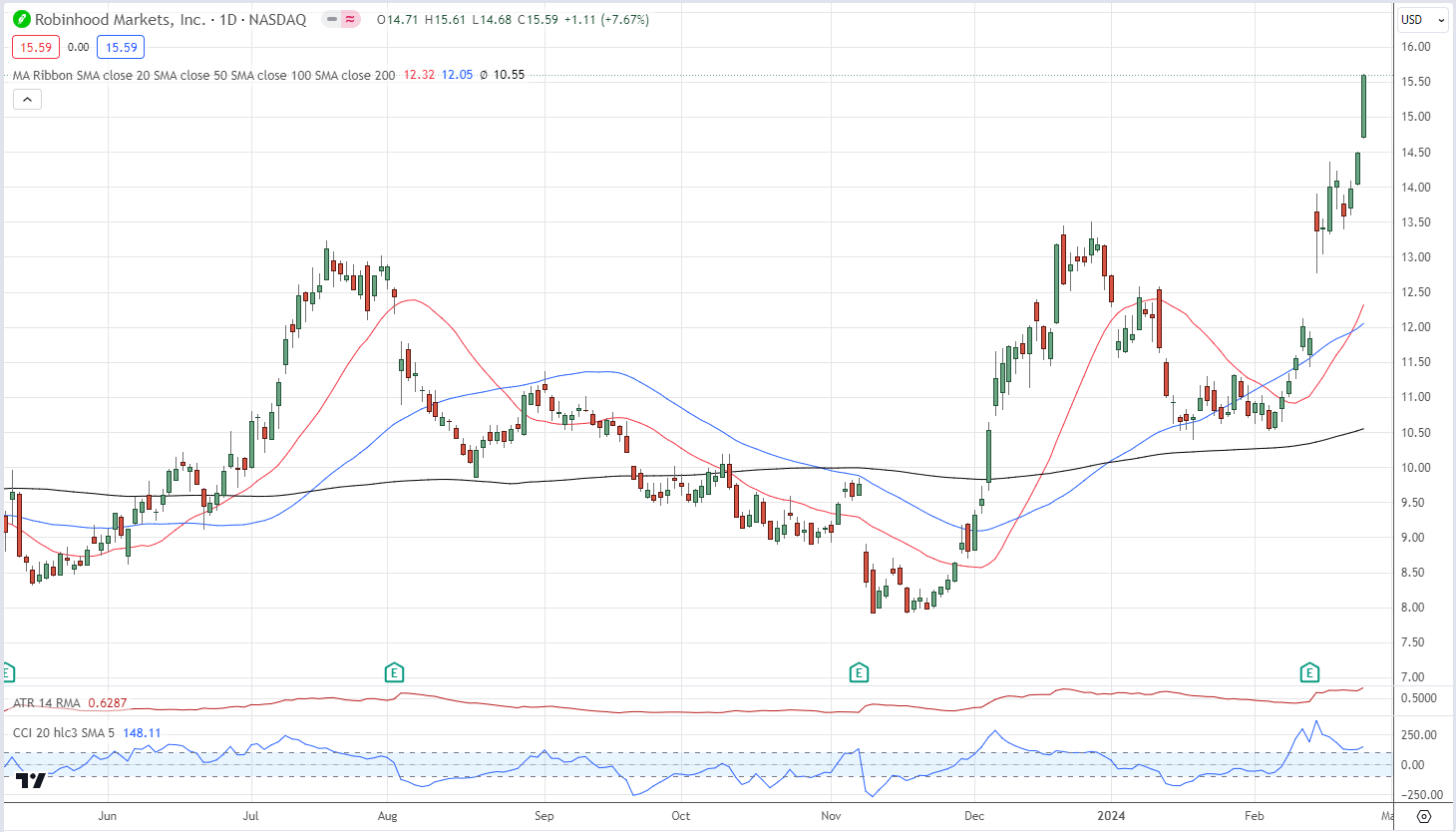

Robinhood (HOOD), a regulated broker-dealer, jumped nearly 8% to a multi-month high of $15.50.

Robinhood (HOOD) Daily Chart

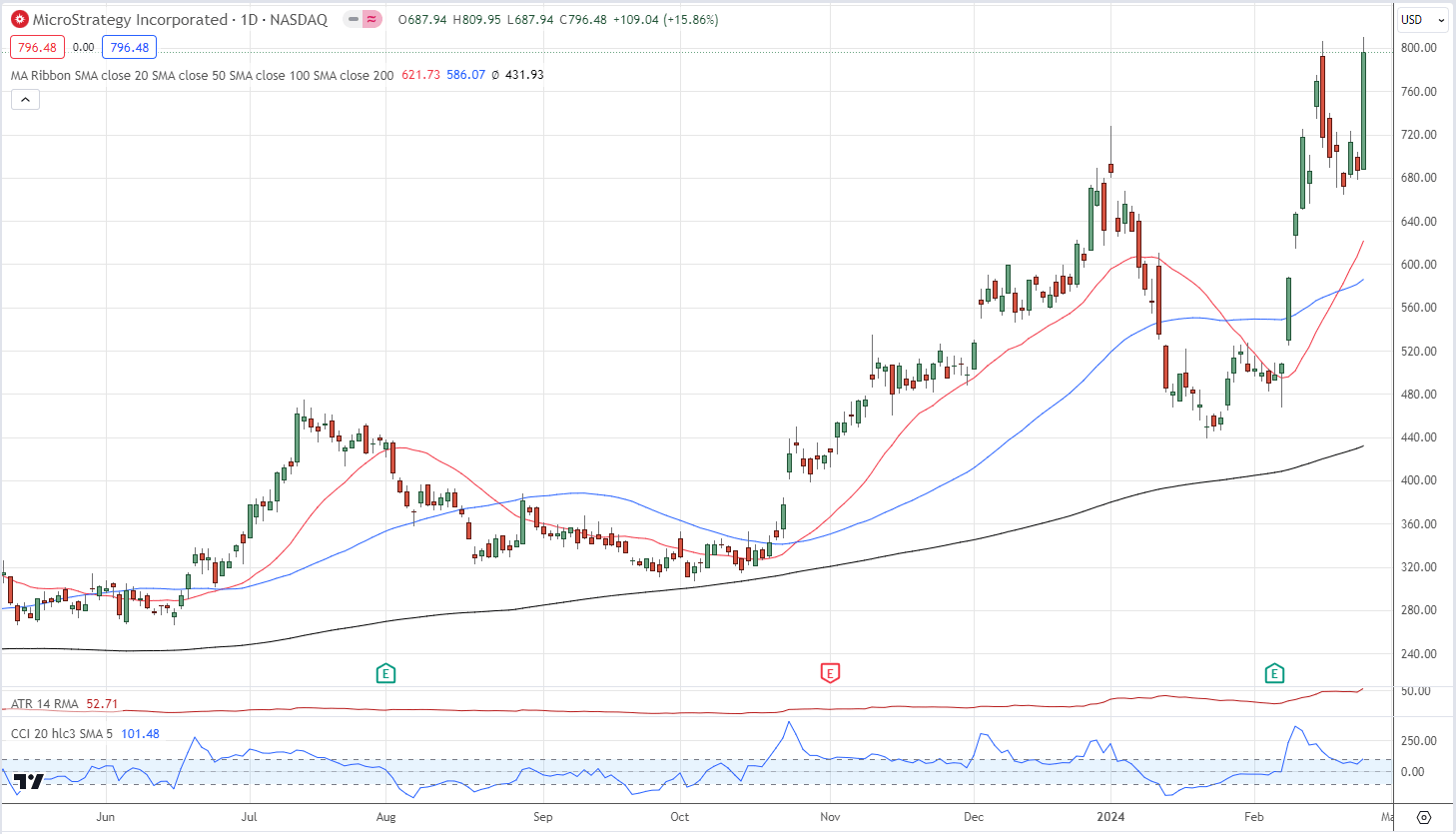

Microstrategy (MSTR) a software and cloud-computing company, now holds 193,000 bitcoin on its books after purchasing an additional 3,000 BTC recently for $155 million. Overall, MSTRs holds 193k BTC at an average price of $31,544, compared a spot BTC price just under $56.5k. Microstrategy rallied by nearly 16% on Monday.

MicroStrategy (MSTR) Daily Chart

All charts via TradingView

What is your view on the cryptocurrency space – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Leave a Reply