Euro (EUR/USD, EUR/JPY) Analysis

- EUR/USD shows signs of bullish fatigue after respecting dynamic resistance

- Recent euro positioning accumulates on the short side but longs look unfazed

- EUR/JPY seeing signs of consolidation ahead of resistance but the yen remains vulnerable

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

How to Trade EUR/USD

EUR/USD Showing Signs of Bullish Fatigue

EUR/USD has taken advantage of the hawkish repricing in the dollar after markets realigned their rate cut expectations with the Fed. Not too long ago, markets were pricing in six 25 basis point cuts to the Fed funds rate and now envision no more than the three the Fed originally communicated to the market at the December FOMC meeting.

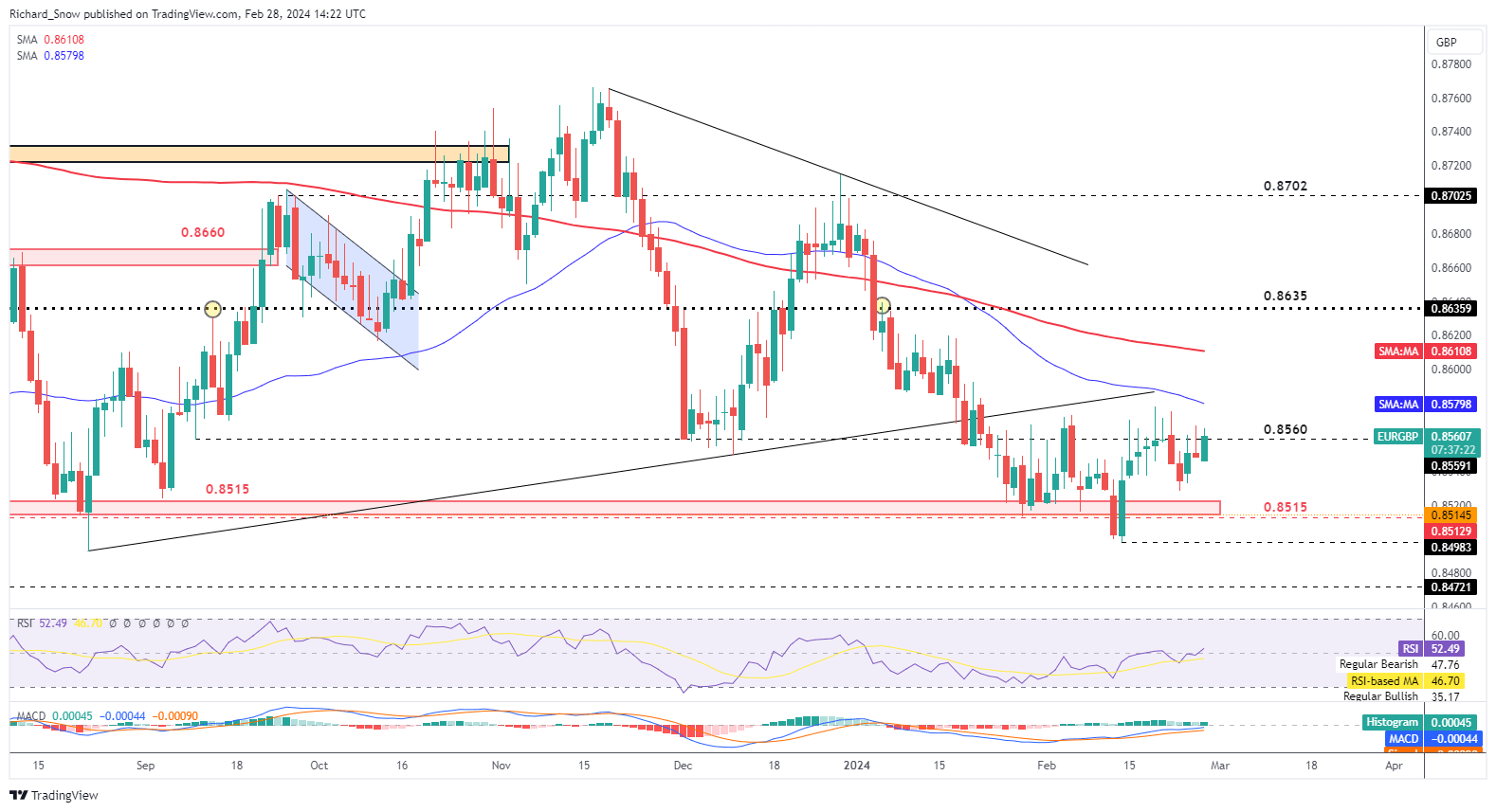

Last week prices attempted to trade above the blue 50-day simple moving average (SMA) but ultimately failed. Again, on Tuesday, an attempt was made to retest the dynamic level of resistance and failed, opening the door to a deeper pullback. The second estimate of US GDP for the fourth quarter was revised 0.1% lower to 3.2% which has seen the pair attempts to recover lost ground from earlier in the day.

According to rates markets, the ECB will likely have to shave 100 basis points off the benchmark interest rate which would create a wider interest rate differential with the US. However, the euro has managed to arrest the decline that ensued at the end of December and remains around 1.0831. Any further declines might bring into focus the 1.0700 level but that may be difficult to come by as the ECB governing council is likely to reject any talk of imminent rate cuts.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

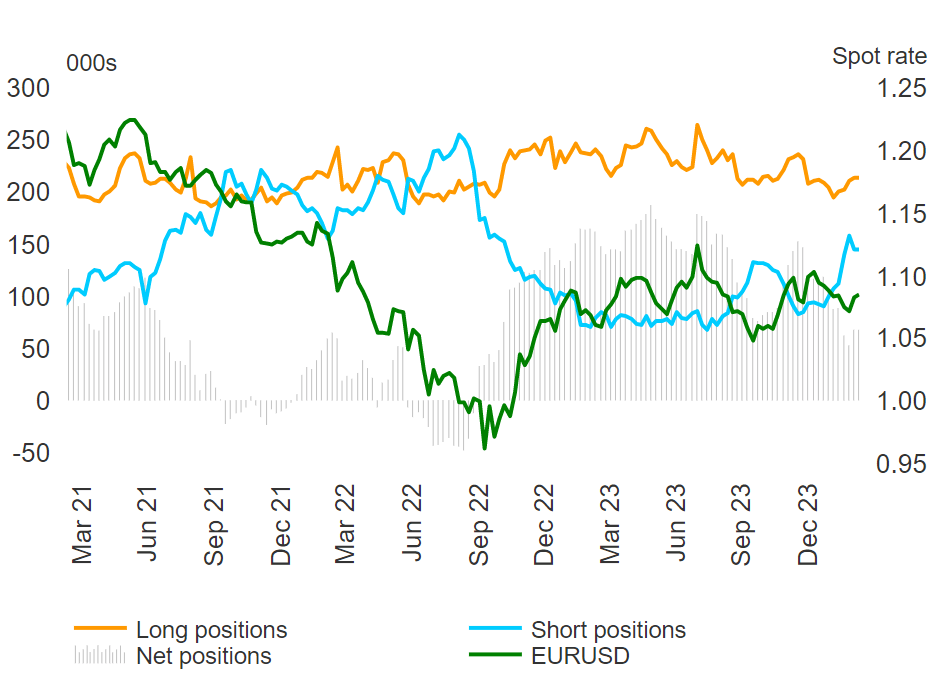

Euro positioning according to the CFTC’s Commitment of Traders report now sees a pick up in short positioning (blue line) but interestingly enough, longs have held relatively steady. The sharp rise in shorts suggests the euro may soon come under pressure.

Euro Positioning via Commitment of Traders Report (net-long positioning subsides)

Source: TradingView, prepared by Richard Snow

| Change in | Longs | Shorts | OI |

| Daily | 8% | -12% | -2% |

| Weekly | 2% | -7% | -2% |

EUR/JPY Showing Signs of Consolidation Ahead of Resistance but the Yen Remains Vulnerable

The EUR/JPY uptrend remains in tact but recent price action hints at a potential slow down ahead of 164.31. The yen remains vulnerable in the absence of direct FX intervention form Japanese officials as the carry trade continues. A pullback in EUR/JPY towards the zone of support around 161.70 will be a challenge and would rely on a weaker euro across the board.

Temporary consolidation appears more likely and a retest of the 164.31 level is not out of the question, particularly if Japan’s top currency official avoids deploying FX reserves to strengthen the yen.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

Euro Data Picks up in the Coming Week

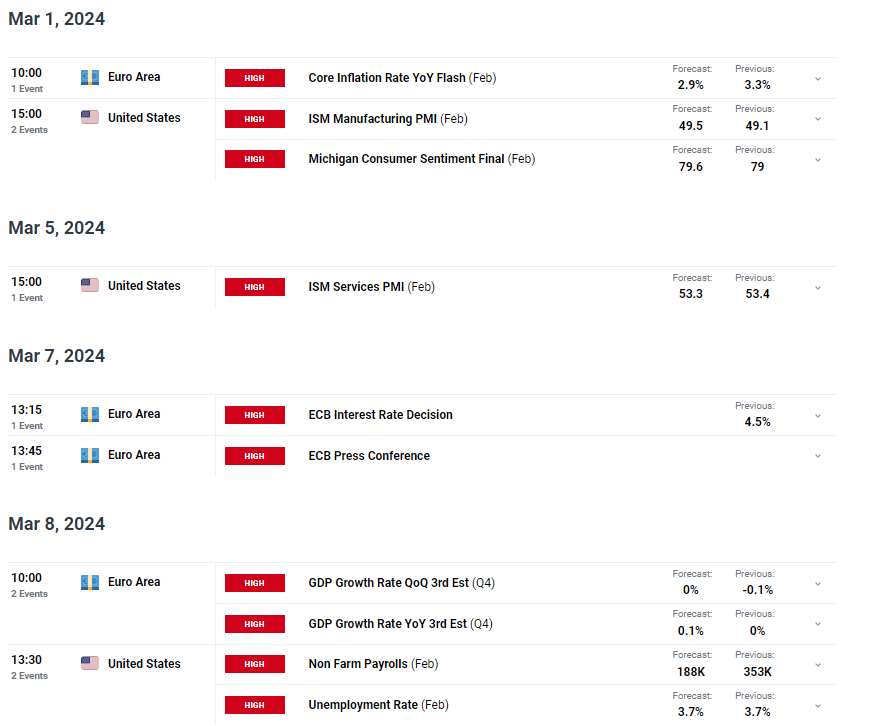

EU core inflation and the March ECB meeting make up the core of incoming EU scheduled risk but there is plenty of ‘high importance’ US data to consider as well. Markets will be looking for much of the same from ISM services data which maintains a 13-month streak above the 50 mark and next Friday sees a rather late US non-farm payroll report.

Customize and filter live economic data via our DailyFX economic calendar

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Leave a Reply