AUD/USD ANALYSIS & TALKING POINTS

- Lack of Chinese stimulus weighs on Aussie dollar.

- RBA’s higher for longer > Federal Reserve.

- Turnaround or continuation for AUD/USD?

Recommended by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar is trading at extreme levels this Monday as the PBoC decided to modestly reduce interest rates (see economic calendar below) on the 1-year LPR while keeping the 5-year rate on hold. This unexpected outcome resulted in the pro-growth AUD weaker against the US dollar despite the DXY marginally lower for the day.

Pricing today across FX markets are relatively subdued with investor uncertainty increasing due to key upcoming risk events including the BRICS summer and Jackson Hole Economic Symposium. With Jackson Hole being the focal point as Fed Chair Jerome Powell could alter the current ‘higher for longer’ narrative, potentially providing some support for the fading Aussie dollar.

VIEW MY RISK EVENT FOR THE WEEK: USD ON JACKSON HOLE SYMPOSIUM

AUD/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

Looking at money market pricing for the Reserve Bank of Australia (RBA) below, expectations for a rate cut does not look to be priced in for 2023 or 2024 unlike the Fed who is forecasted to cut around May of 2024. Should Fed Chair Jerome Powell push a more accommodative stance this week, this interest rate differential may further augment any AUD upside.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

RBA INTEREST RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

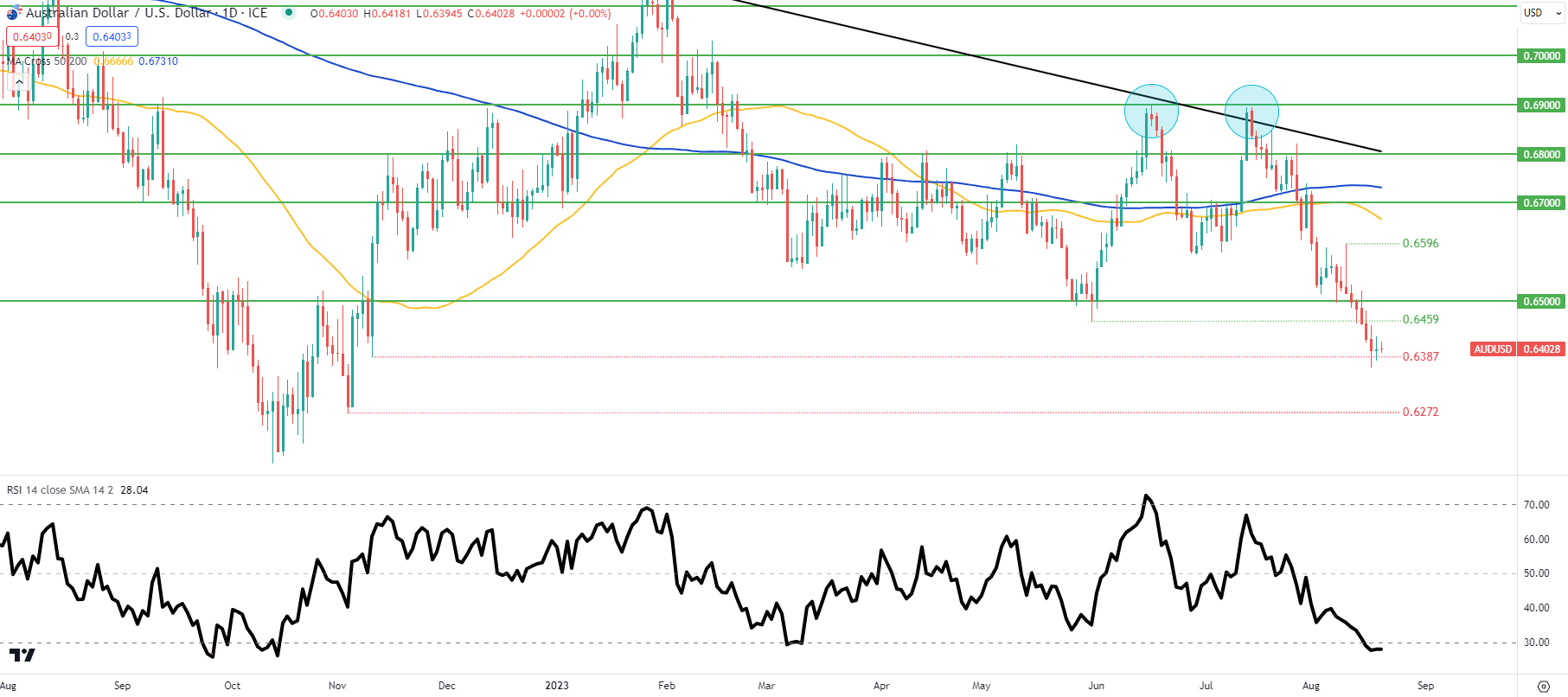

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, TradingView

Daily AUD/USD price action continues to hover around the 0.6387 swing support and a daily confirmation candle close could spark another leg lower towards the November 2022 low at 0.6272. That being said, the Relative Strength Index (RSI) is now in oversold territory and could indicate a possible end to the recent downtrend although moving against the prevailing trend carries a high degree of risk.

Investors may want to wait for the fundamental drivers to take place before entering the market as Jackson Hole traditionally carries significant price swings. Trader hesitancy has already commenced with the latest slew of doji candlesticks that could point to a pause before a resumption of the downtrend or a shift.

Key resistance levels:

Key support levels:

IG CLIENT SENTIMENT DATA: BULLISH (AUD/USD)

IGCS shows retail traders are currently net LONG on AUD/USD, with 81% of traders currently holding long positions. Download the latest sentiment guide (below) to see how daily and weekly positional changes affect AUD/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

Leave a Reply