HANG SENG, ASX 200, FTSE STRAITS TIMES INDEX – Outlook:

- Asian indices have fallen sharply after weak China data.

- The Hang Seng Index has broken below key support.

- What is the outlook for the ASX 200 index and the FTSE Straits Times Index?

Recommended by Manish Jaradi

Traits of Successful Traders

Asian indices have fallen sharply after China’s manufacturing activity contracted faster than expected in May – another sign that China’s post-Covid recovery is losing momentum.

The official manufacturing PMI dropped further into contraction territory to 48.8 in May from 49.2 in April, compared with expectations of 49.4. This follows a string of weaker-than-expected data, including retail sales, industrial output, and fixed asset investment amid deepening producer price deflation.

Consensus Growth Expectations

Source data: Bloomberg; Chart prepared in Excel

China’s economic outlook has steadily improved after Beijing lifted relaxed Covid restrictions, prompting a significant upgrade in China consensus economic growth forecasts for 2023 (see chart). Most recently, though, some of the optimism has scaled back, as reflected in the slight downgrade in those assessments. Key focus will be on anystimulusmeasures to support the economy which could cushion some of the downside risks.

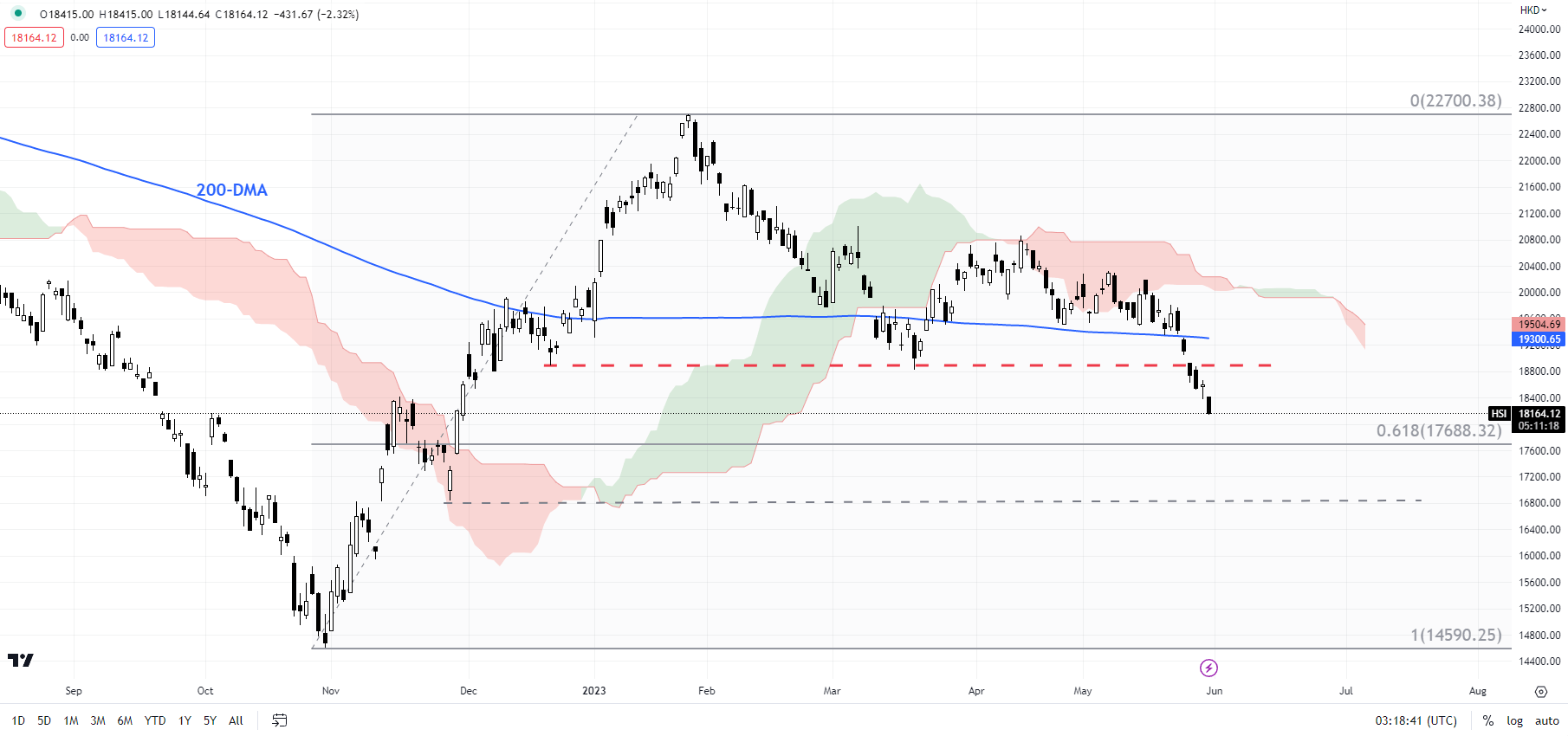

Hang Seng Index Daily Chart

Chart Created by Manish Jaradi Using TradingView

Hang Seng Index: Breaks below key support

The Hang Seng Index has broken below key horizontal trendline support at about 18800, reversing the higher-top-higher-bottom sequence that began in late 2022. This follows a failure in April to rise above a vital ceiling at the March high of 21000. The index looks set to drop toward 17680 (the 61.8% retracement of the October 2022-January 2023 rally). Subsequent support is seen at the end-2022 low of 16830. On the upside, HSI, at minimum, would need to rise above the 200-day moving average for the downward pressure to begin fading.

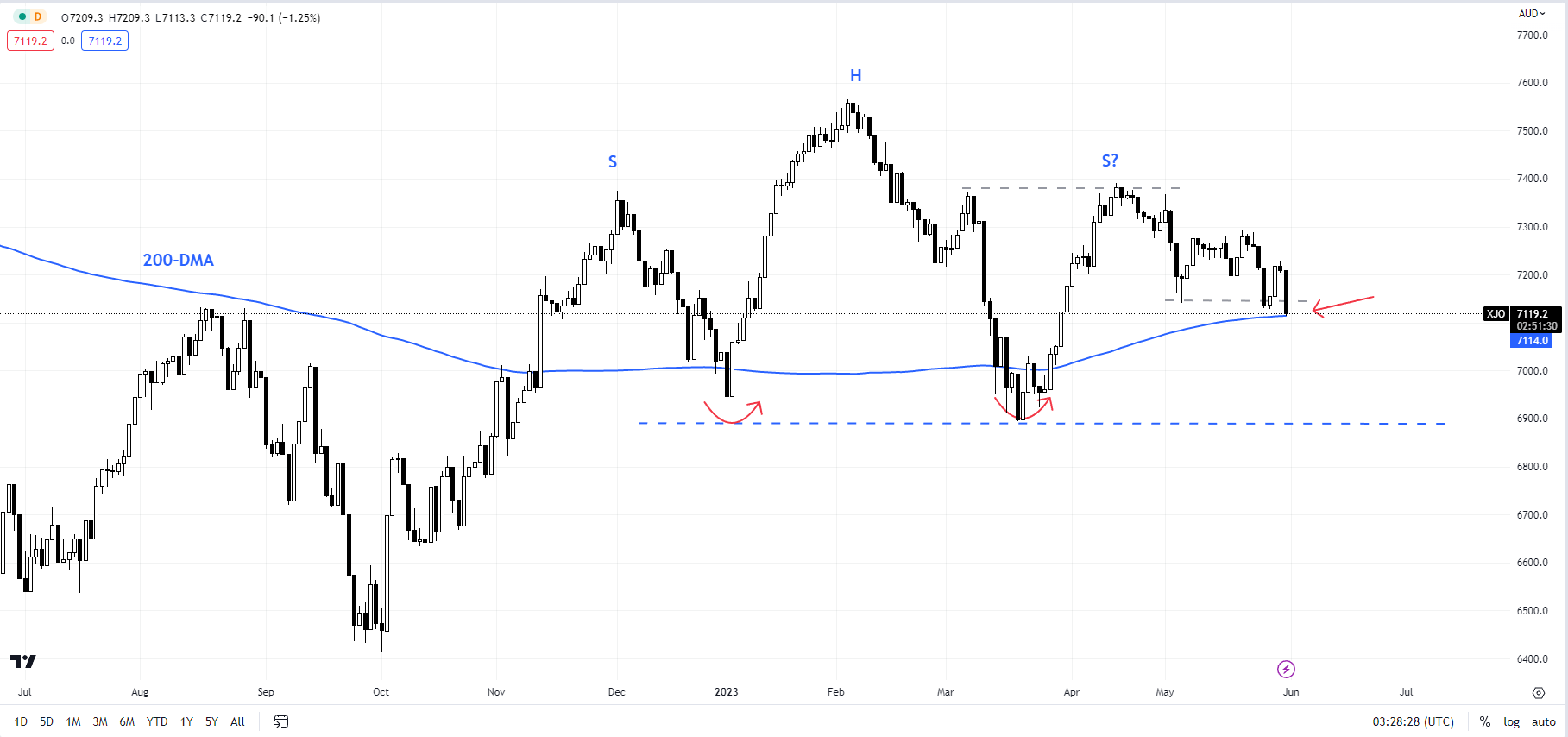

ASX 200 Index Daily Chart

Chart Created by Manish Jaradi Using TradingView

ASX 200 Index: Tail risk bearish scenario

Probably a tail-risk scenario, but one that can’t be ignored. There is a potential head & shoulders pattern developing in the Australia ASX 200 index (the left shoulder at the December high, the head at the February high, and the right shoulder at the April high). There is a long way to go before the neckline (that comes at about 6900), and in all fairness, the pattern might not get triggered at all. Still, one needs to be mindful given the index is now attempting to break below immediate support at the early-May low of 7141, around the 200-day moving average. A decisive break could raise the odds of a drop toward the neckline.

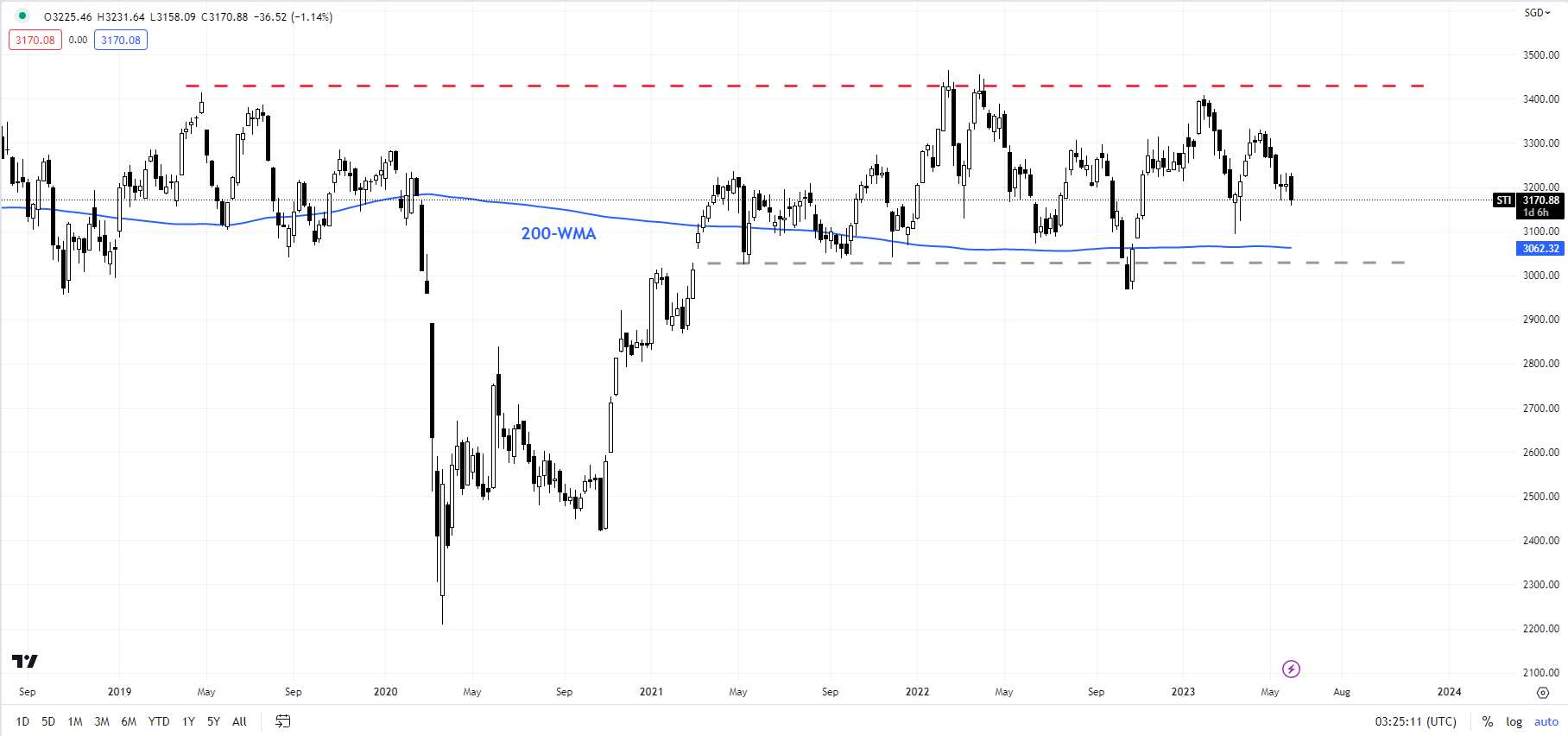

FTSE Straits Times Index Weekly Chart

Chart Created by Manish Jaradi Using TradingView

FTSE STI: Risks a drop toward the lower end of the range

The retreat in February from stiff resistance on a horizontal trendline from 2019 and the subsequent lower high created in April has raised the odds of a drop toward the lower end of the range. Singapore FTSE Straits Times Index has been sideways for many months, and it looks like it may take a while before it starts trending again. Critical support is on the lower edge of the range at about 3025, near the 200-week moving average. A decisive break below could threaten the post-Covid uptrend.

Recommended by Manish Jaradi

The Fundamentals of Range Trading

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

Leave a Reply